The Australian dollar (AUD) continues to strengthen against the Japanese yen (JPY). All the commodity currencies are strong against the US dollar also. Below is a weekly chart of AUD/JPY showing a break of the downtrend, a backtest and now price moving higher.

We had a yearly cycle low last June, so the next yearly cycle low is not due until mid 2018, so there is plenty of TIME for the AUDJPY to continue to strengthen.

Why is this relevant? AUD is a proxy for inflation, risk-on, and bullish metals and mining. JPY is a proxy for deflation, risk-off and bearish metals and mining. Therefore, a bull market in AUDJPY, which is what we have here now, is bullish for the metals and mining sectors, commodities and therefore commodity price inflation.

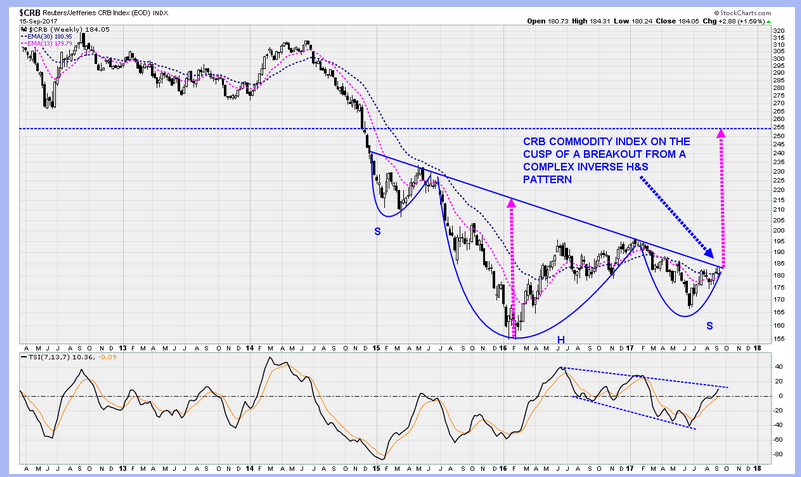

Further, the CRB Commodity Index weekly chart below is on the cusp of breaking out from a complex inverse head and shoulders pattern, with a projection about 40% higher than here. This further the validates the AUDJPY bull market, which is metals and mining and generally commodities bullish. This means commodity inflation is heading our way, which is precious metals sector bullish, given that real interest rates (nominal rates less inflation) will probably go negative, if they're not there already.

The general sector themes are:

1. Long commodity based currencies (metals and mining bullish).

2. Long emerging markets, especially China, Brazil, Russia and Vietnam.

3. Long industrial metals, precious metals including gold and silver, and the miners of these metals.

4. Long coal sector and Long strategic metals.

5. Neutral Energy Sector, Neutral USA Equities and Neutral other Developed Market equities, except Australia and Canada (commodity producers).

The current sector weightings are:

1. 40% LONG industrial metals and miners

2. 38% LONG precious metals and miners

3. 22% LONG Brazil, Russia, China and Vietnam