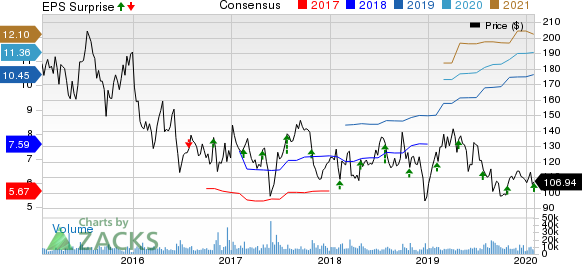

Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) posted fourth-quarter 2019 adjusted earnings of $2.71 per share, which improved 26.6% from the year-ago quarter’s $2.14. Earnings also beat the Zacks Consensus Estimate of $2.37.

Moreover, revenues rose 22.6% year over year to $1.38 billion in the reported quarter and surpassed the Zacks Consensus Estimate of $1.32 billion. Revenues were driven by higher sales of Soliris, Strensiq, Kanuma and Ultomiris.

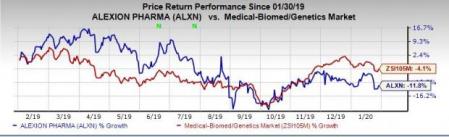

Shares of Alexion have lost 11.8% in the past year compared with the industry’s decline of 4.1%.

Revenues in Detail

Soliris (for the treatment of paroxysmal nocturnal hemoglobinuria [PNH] and atypical hemolytic uremic syndrome [aHUS]) sales were up 4% year over year to $1013.1 million in the reported quarter, driven by strong volume growth.

Strensiq revenues were $166.8 million (up 32% year over year). Kanuma (lysosomal acid lipase deficiency [LAL-D]) contributed $34.1 million (up 33% year over year) to quarterly revenues.

Ultomiris’ (ravulizumab-cwvz) net product sales were $170.2 million in the reported quarter, reflecting a sequential increase of 89.3%.

Cost Summary

Adjusted research and development (R&D) expenses were $226.7 million, up 38.2% year over year.

Adjusted selling, general and administrative (SG&A) expenses were $340 million, up 22.3% year over year.

2019 Results

Alexion posted 2019 adjusted earnings of $10.53 per share, up 33% from the last year’s figure of $7.92.

The company reported sales of $4.99 billion, up 20.8% year over year.

2020 Guidance

Alexion expects adjusted earnings per share of $10.65-$10.85. The company projects revenues of $5.50-$5.56 billion. The Zacks Consensus Estimate for earnings is pegged at $11.36 per share and for sales at $5.62 billion. Both the earnings and sales guidance fall below the estimates.

Combined revenues from Soliris and Ultomiris are expected to be $4.76-$4.80 billion.

Pipeline Update

In November 2019, Soliris was approved for adults with anti-aquaporin-4 (AQP4) auto antibody-positive neuromyelitis optica spectrum disorder (NMOSD) in Japan. Alexion plans to initiate a phase II/III study in children and adolescents with NMOSD in the first quarter of 2020. Another phase III study on Soliris is underway for addressing children and adolescents with Generalized Myasthenia Gravis (gMG).

Meanwhile, applications for the approval of Ultomiris in aHUS are under review in the EU and Japan.Another phase III study of Ultomiris in children and adolescents with aHUSis underway. Also, a phase III study on Ultomiris in children and adolescents with PNH is underway.

Enrollment is complete in a single, PK-based phase III study of Ultomiris, delivered subcutaneously once per week, to support registration in PNH and aHUS. Data are expected in the first half of 2020. Another phase III study of the drug for the treatment of gMG is ongoing. In December 2019, Alexion initiated a phase III study of Ultomirisin NMOSD.

In November and December 2019, applications for the approval of the Ultomiris100mg/mL formulation were submitted in the EU and the United States, respectively. This high-concentration formulation is designed to reduce infusion time by more than 50% to approximately 45 minutes. Alexion plans to file for regulatory approval of this formulation in Japan in mid-2020.

In December 2019, Alexion submitted an investigational new drug application (IND) for Ultomiris in Amyotrophic Lateral Sclerosis (ALS) to the FDA. In January 2020, the company announced the planned initiation of a pivotal phase III study in the first quarter of 2020.

Recent Developments

Earlier this month, Alexion acquired clinical-stage biopharmaceutical company Achillion Pharmaceuticals, Inc. for $930 million.

The acquisition adds Achillion’s lead candidate danicopan (ACH-4471), currently in phase II development for C3 glomerulopathy (C3G), and ACH-5228, which is in phase II development for PNH to Alexion’s pipeline. . Alexion is looking to strengthen its PNH franchise with this buyout as a potential approval of danicopan will make the company a market leader in the PNH space.

Our Take

Alexion’s earnings and sales topped estimates in the fourth quarter of 2019. With the recent label expansion of Soliris, we expect the drug to continue driving growth. Ultomiris has also gained traction.. The company is also looking to expand the label of Ultomiris which should further boost sales for the company.

Zacks Rank & Other Key Picks

Alexion currently carries a Zacks Rank #2 (Buy).

A few top-ranked stocks in the biotech sector are BioDelivery Sciences International Inc. (NASDAQ:BDSI) , Guardant Health Inc. (NASDAQ:GH) and Denali Therapeutics Inc. (NASDAQ:DNLI) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BioDelivery’s loss per share estimates have narrowed from 22 cents to 16 cents for 2019 in the past 90 days. The company delivered a positive earnings surprise in the trailing four quarters by 159.38%, on average.

Guardant’s loss per share estimates have narrowed from $1.27 to 88 cents for 2019 and from $1.29 to $1.13 for 2020 in the past 90 days. The company delivered a positive earnings surprise in the trailing four quarters by 39.21%, on average.

Denali’s loss per share estimates have narrowed from $2.04 to $2.02 for 2019 and from $2.40 to $2.39 for 2020 in the past 90 days.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases. Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

BioDelivery Sciences International, Inc. (BDSI): Free Stock Analysis Report

Alexion Pharmaceuticals, Inc. (ALXN): Free Stock Analysis Report

Guardant Health, Inc. (GH): Free Stock Analysis Report

Denali Therapeutics Inc. (DNLI): Free Stock Analysis Report

Original post

Zacks Investment Research