Whenever an industry leader trades at a cheap valuation it should draw the attention of investors, and that’s exactly the situation we see with Aflac (NYSE:AFL) ($62/share). Concerns over currency weakness in Japan, where AFL derives 75% of its revenue, have kept the stock price down. However, these concerns are overstated. AFL has the cash flow to support its valuation even if the Yen weakens further while it has significant potential upside if the exchange rate improves. Changes from the Affordable Care Act in the U.S. also present Aflac with significant opportunity.

The Top Name in Health & Life Insurance

I’ve written bullish articles on property and casualty insurers like The Chubb Corporation (NYSE:CB)) and Aspen Insurance Holdings (AHL) recently. While I do have high expectations for these stocks, that sector carries more inherent risk as a massive natural disaster could hit any time and significantly increase their costs. There is a little more volatility in P&C insurers’ business model than that of health and life insurers.

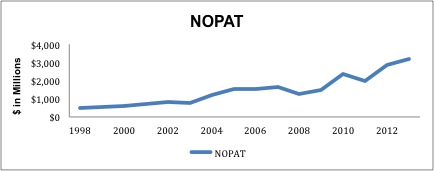

Health and life insurers enjoy significantly more stable costs over time. AFL’s history attests to the stability of its industry. Over the past 10 years, AFL has grown after-tax profit (NOPAT) by 15% compounded annually. In only two out of those ten years did AFL’s NOPAT decline. This consistent growth has helped AFL to earn a top-quintile return on invested capital (ROIC) of 16%. Figure 1 tracks AFL’s NOPAT for the past 15 years.

Figure 1: Steady Growth

AFL’s 16% ROIC is top amongst the 18 health and life insurers that we cover, while its 13% NOPAT margin ranks third. Combine that with its impressive brand recognition (the ubiquitous duck), and it’s clear that AFL is one of the strongest companies in its industry.

Japanese Business Is Growing Rapidly

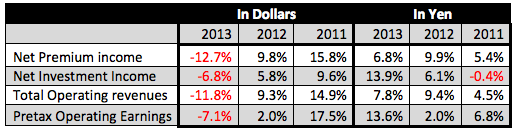

At first glance, the results from Aflac Japan for 2013 look bad. Revenues declined by 12% and reported operating earnings declined by 7%. However, these declines were entirely due to weakness in the Japanese yen. The average yen/dollar exchange rate was 22% higher in 2013 compared to 2012.

Figure 2 is a table from AFL’s 2013 10-K that shows how Aflac Japan actually grew significantly in 2013 if one discounts the effect of the weak yen.

Figure 2: Yen vs. Dollar Results - Percentage Changes

It’s important to note that most of Aflac Japan’s profits are not converted into dollars. Last year, only $771 million (8% of operating cash flow) was repatriated from Aflac Japan to Aflac U.S. Most of AFL’s yen holdings are reinvested back into the business, so the exchange rate fluctuation does not have that large an effect on their operations.

The right side of figure 2, which strips away the impact of exchange rates, shows that Aflac Japan is growing at a healthy rate. I’m not a currency expert, and I don’t pretend to know what the yen will do against the dollar in the near future. However, AFL has a strong enough business to withstand further weakening of the yen, and if the yen strengthens earnings are going to experience a major surge.

Opportunity in the U.S.

Even though U.S. operations only make up 25% of AFL’s revenues, the company’s domestic operations still have significant growth potential. Numerous reports have suggested that more businesses and individuals are buying supplemental health insurance policies—AFL’s core business—as a result of the Affordable Care Act. Assurant Health Insurance (AIZ) CEO Rob Pollock seemed to confirm this in the company’s Q1 earnings call when he referenced the strong sales of the company’s supplemental health insurance products.

AIZ beat revenue and earnings estimates handily, and I would expect AFL to do the same when it reports on April 29. Especially given AFL’s large share buyback authorization I would expect the company to beat on EPS.

Cheap Valuation Means Low Risk

Even if AFL doesn’t beat expectations this quarter, the company remains a solid long-term bet. Fears over the yen have kept the valuation down below reasonable levels. At its current valuation of ~$62/share, AFL has a price-to-economic book value of 1, which implies that the company will never grow profits again. Those are very low expectations for a company that done 15% compounded annually over the past decade.

With even modest growth, AFL has significant potential upside. If we give AFL credit for NOPAT growth of just 6% compounded annually for 10 years, the stock has a fair value of ~$81/share. If the yen ends up strengthening against the dollar, profits could grow much more rapidly and AFL could have an even higher potential upside.

In this high-risk environment, AFL is a safe choice. Its cheap valuation and large buyback authorization should limit the downside, while solid growth gives it a large potential upside.

Blue Chip Investor Fund (BCIFX) allocates 7.3% of its assets to AFL and earns our Attractive rating, making it a solid choice for investors who want exposure to AFL without holding the stock directly.

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.