All the world loves a lover, and all the world hates a bear. It’s never easy being the ursine type in this world, but I’m truly starting to believe that it’s worse than ever. For approaching five years now, the central bankers of the world have succeeded in snuffing bears out of existence, one by one. And during the few times that it seemed there would be hope, the amount of time it takes to turn things around again gets shorter and shorter.

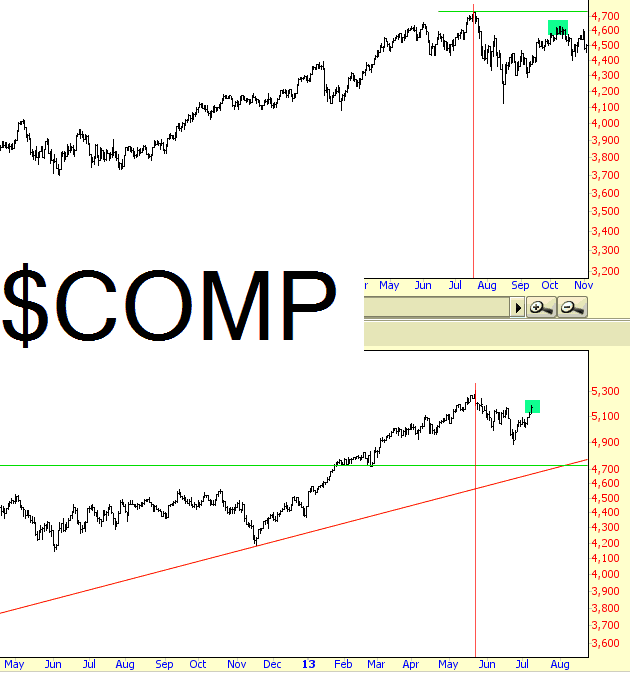

This most recent example is a good one, and it illustrates nicely how the length of time for any down market is getting comically brief. We shed about 1,000 Dow points between late May and late June, but whoomp, those losses have been largely undone, and in some cases, indexes are reaching the highest points seen in the history of the universe (like, say, the Russell 2000).

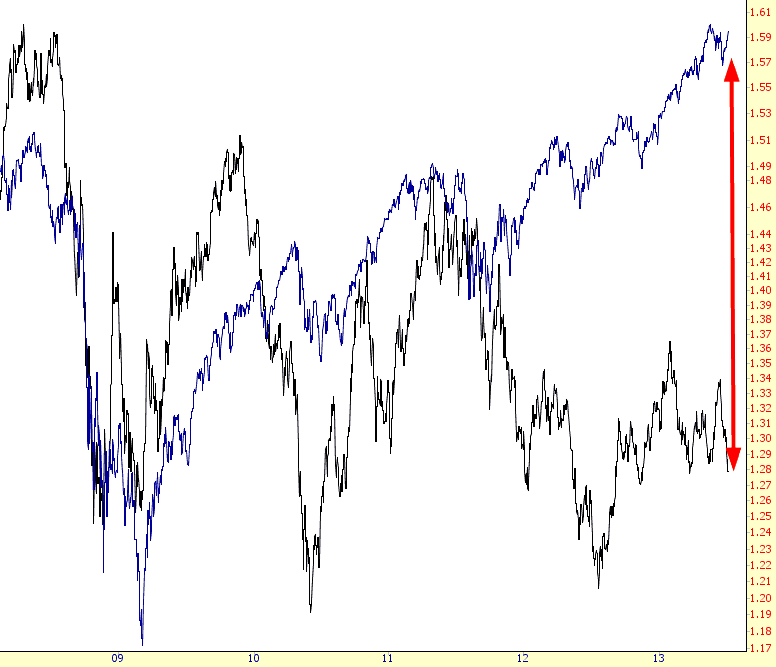

Even such gigantic market forces as the Euro aren’t able to coax stocks lower. Below is a chart showing the S&P (in blue) and the Euro (in black). It wasn’t that long ago a collapsing Euro would have dragged stocks down too. Just take a look at the spread now. Equities couldn’t give a flying crap that the Euro is free-falling.

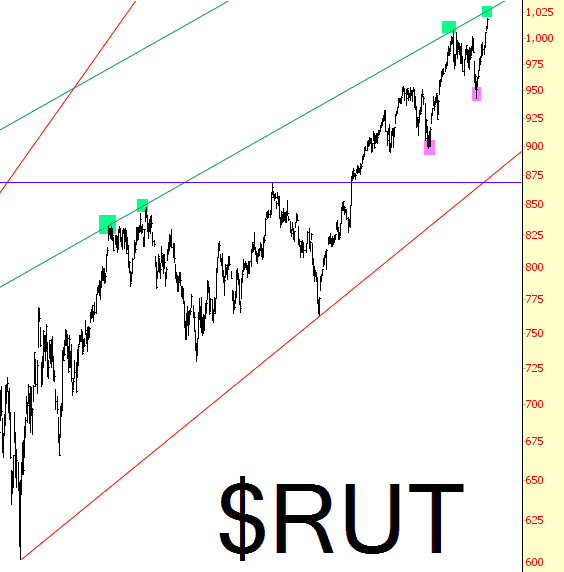

The Russell is spitting distance from its upper trendline. What’s also distressing is that even times that the Russell has sold off, it didn’t even come close to meeting its lower trendline. There’s simply too much strength.

I think Wednesday is pretty much the last chance for bears. If the Fed minutes come out, and the market continues to rally, I think it’s clear that equities have told Tapering to go and shove it. One wispy possibility is that, as in 2007, the lower high following a lifetime high marks an important, long-term turning point in the market. As disappointed as I’ve been over the years, I’m not counting on it.

If I sound down, it’s because I am. The market is in la-la land again, and just moments ago I saw a headline story featured on Yahoo from a prominent blogger stating the “Valuations Don’t Matter.” This bubble has gotten gigantic, and the thing with bubbles is that you never know if you’re one day or three years away from the time it finally, at long last, starts to deflate.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Free Falling Euro, Rising Equities: Getting Rid Of The Bears?

Published 07/10/2013, 01:19 AM

Updated 07/09/2023, 06:31 AM

A Free Falling Euro, Rising Equities: Getting Rid Of The Bears?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.