Relying on a handful of customers poses a great risk to the sustainability of one’s business. Currently, the perfect example of this is companies including, Cirrus Logic, Inc. (NASDAQ:CRUS) , Qorvo, Inc. (NASDAQ:QRVO) and Infineon Technologies AG (OTC:IFNNY) , all of which have been affected by a high customer concentration.

It should be noted that Apple Inc. (NASDAQ:AAPL) is the largest customer of the aforementioned companies, and the firm’s sales of iPhones have been below expectations, particularly the latest one — iPhone X. Owing to the troubles, this January Apple slashed its production target by half from almost 40 million projected during the iPhone X release, per Nikkei.

Moreover, Apple reported a dismal iPhone unit sales performance in the first quarter of fiscal 2018 thanks to the lower-than-expected holiday season sales of its premium device iPhone X. For the quarter ending Dec 31, 2017, iPhone unit sales edged down 1% year over year.

Goldman Sachs’ latest prediction on iPhone sales has put further shadow on the growth prospects of Apple’s component suppliers. The investment firm, in its Mar 27 note, announced trimming iPhone sales expectations by a whopping 1.7 million units to 53 million, for the March quarter. Also, for the quarter ending June, the firm forecasts sales of 40.3 million units, a decline of 3.2 million from the previous projection.

Lesser production implies lesser component requirement, which, in turn, will have a substantial impact on suppliers.

Let’s see how the lackluster iPhone sales performance has hit the above-mentioned three major iPhone component suppliers.

Cirrus Logic is the worst affected company. The company generates more than 75% of its revenues by selling audio chips which are used in iPhone devices. During the last reported quarter, the company witnessed a 7.7% decline in revenues mainly due to the sudden fall in demand for smartphones in the later part of December 2017. Cirrus Logic provided a tepid outlook for the fourth quarter of fiscal 2018 too. This Zacks Rank #5 (Strong Sell) stock has depreciated 25.7% in the year so far.

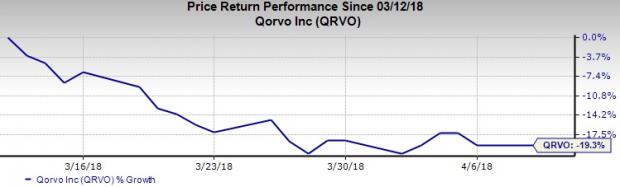

Qorvo — a provider of radio frequency chips to Apple — also falls in the same category. Apple accounted for 34% of the company’s total revenues in fiscal 2017. Although the company’s last-quarter revenues were slightly affected, a disappointing revenue outlook for fourth-quarter fiscal 2018 indicates that it will be hit significantly by the iPhone X production cut. In the last month, shares of this Zacks Rank #4 (Sell) company have slipped 19.3%.

The third major component supplier likely to be affected by sluggish iPhone sales is Infineon Technologies. The company furnishes cellular basebands for Apple which forms the core chipsets used in iPhones. During the last-quarter earnings conference call, the company lowered its fiscal 2018 revenue outlook and provided a disappointing sales guidance for the fiscal second quarter. The Zacks Rank #3 (Hold) stock has lost 10.9% in a month’s time. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Editor-in-Chief Goes ""All In"" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

Qorvo, Inc. (QRVO): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Infineon Technologies AG (IFNNY): Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS): Free Stock Analysis Report

Original post

Zacks Investment Research