- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Hedge Fund

What is a Hedge Fund?

Hedge funds are private investment vehicles that are offered and managed by professional investment firms, usually set up as LLCs, LLPs or an entity with a similar structure. Complex investment strategies are utilized by the managers of these funds to maximize return for risk capital pooled from wealthy individuals and institutions.

As a rule, these types of funds require large initial minimum investments. That makes them open only to wealthy, accredited investors. In addition, investors in such funds may have limited opportunities to withdraw their capital once it has been added to the hedge fund since a sizeable and reliable pool of capital allows hedge fund management to use their leverage for savvier investing while weathering account drawdowns more easily.

Hedge funds got their name from Alfred W. Jones who coined the phrase “hedged fund” in 1949 when he created an instrument that focused on taking long-term stock positions while selling other stocks short, as a way of managing risk. This strategy was also used in the 1920s, but the term did not gain traction at that time. Hedge fund success attracts wealthy investors with risk capital, allowing hedge fund managers to explore more creative and often complex investment strategies.

How does a hedge fund work?

A fund’s prospectus, or offering memorandum, provides investors with the fund’s investment strategy, investment type, and leverage limit. The four major categories of strategies are global macro, directional, event-driven, and relative value or arbitrage.

- Global macro strategies focus on equity, bond, or currency positions driven by worldwide macroeconomic events. Directional strategies typically focus on trends and counter trends in equity markets, by offsetting long-term positions with short-term counter trades.

- Event-driven strategies focus on corporate events that could dramatically change the value of a stock, e.g., bankruptcies, liquidations, and mergers. Relative value or arbitrage strategies seek the return from price discrepancies such as unusually priced securities relative to their peers.

Each hedge fund has its own style or niche that’s highly influenced by the fund’s management team. Some hedge funds use complicated and high-risk practices that can include seriously leveraged positions and complex algorithms.

Other hedge funds are more traditionally managed, relying heavily on a manager’s unique ability to pick winning investments. Managers are free to use any combination of these styles to achieve the goals set forth in the prospectus.

Hedge Fund Manager Fees

Typically, hedge funds charge for both management and performance. Management fees are often between 1% and 4% of the net asset value of the fund, per annum, although 2% is most common. The performance fee is often 20% of the year’s profits, although the percentage can be as low as 10% and as high as 50%.

This performance fee can be affected by a “loss carryforward provision” that requires losses in previous years to be recovered before a performance fee can be assessed.

Who Can Invest in Hedge Funds?

Only accredited investors--the definition differs by country--can invest in hedge funds. They are typically high net-worth individuals, banks, financial institutions and other large corporations with considerable reserves of capital.

In the United States, the Securities and Exchange Commission (SEC) defines an accredited investor in rule 501 of Regulation D. This rule stipulates that an individual--or married couple--can qualify as an accredited investor if they have a net worth of at least $1,000,000, not including equity in a primary residence. Alternatively, a high yearly income can qualify if it is above $200,000 per year for the last two years, or $300,000 if married, with the likelihood of earning the same amount in the next year.

Hedge fund regulations are not as strict as the regulations that are designed to protect mutual fund investors. For example, some hedge fund managers are not required to register or file public reports with the SEC. However, the same laws that prohibit fraud apply to hedge funds, and managers owe investors a fiduciary duty, meaning they are required to act solely in the interest of their client.

Picking Hedge Fund via Investing.com

Though Investing.com doesn’t cover hedge fund results, the Financial News page at Investing.com includes real-time news and information about events around the world, including hedge fund managers and funds making the news.

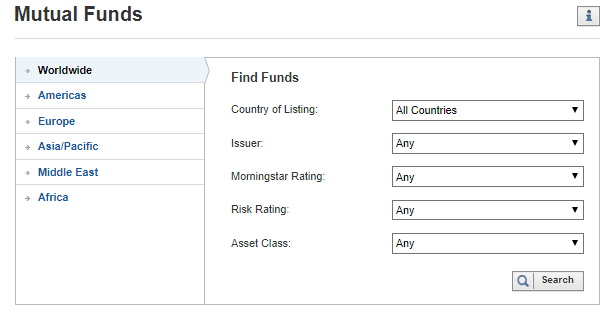

The Mutual Funds page provides investors with detailed and searchable information from around the world. Some mutual funds may be good proxies for the desired hedge fund if an investor is not accredited.