- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Gross Margin

What is Gross Margin?

A company’s gross margin is the profitability percentage of its generated revenues.

The calculation for a company’s gross margin subtracts the cost of goods sold (COGS) from total revenue to determine the net revenue derived from producing those goods. That net revenue is then divided by the total revenue to arrive at a percentage, which shows how much revenue is being retained by the company as a result of the operation.

The gross margin calculation is:

Gross Margin% = (Revenue-COGS) / Revenue

Often calculated for the trailing twelve months (TTM)

A higher percentage signifies a more profitable operation. This calculation is an indication of how efficient a company is at generating its products. When compared to industry peers, the gross margin shows how well managed a company is relative to competitors.

Gross Margins in Practice

Imagine company XYZ spends $100,000 on manufacturing materials and $150,000 on labor costs to generate $500,000 in sales revenue TTM. Its Gross Margin would be 50%.

($500,000 - $250,000)/$500,000 = 0.50

Company XYZ can then compare this result to previous periods, e.g., a five year average (5YA), as well as to competitors in order to make adjustments. For example, if company ABC is a competitor and their Gross Margin if 55% and company XYZ knows that company ABC buys its materials from different suppliers, company XYZ could ask its suppliers for better prices.

Alternatively, if the costs of company ABC are the same but it is selling its products for higher prices, company XYZ may be able to increase prices to reach a better multiple.

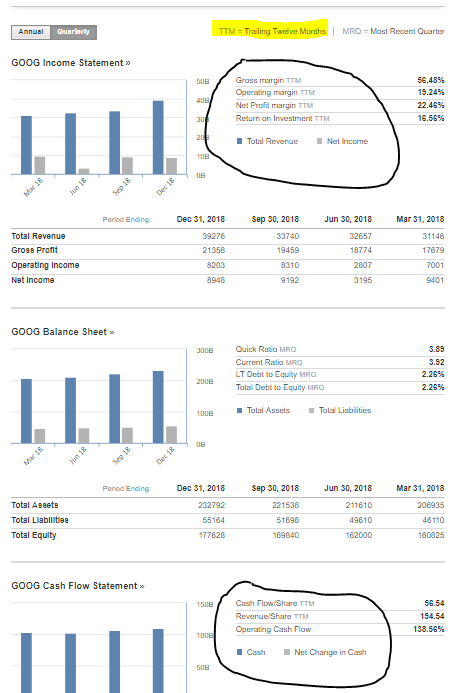

Finding Gross Margins on Investing.com

At Investing.com, Gross Margin calculations can be found via the Ratios link, under the Financials tab, located on each company’s main page, e.g. Alphabet (NASDAQ:GOOGL).

Under the Profitability section, the company’s Gross Margin is listed for both TTM (trailing twelve months) followed by 5YA (five-year average). If the TTM percentage is higher than the 5YA percentage, it signals that the efficiency of the company is improving.