Last week was a positive one in both the stock and bond markets as investors stepped back in.

Earnings reports in some sectors (financials) were not as weak as some expected, and there continues to be interim cooling of inflation (gas down the past month). Also, Bank of America’s Global Fund Manager survey shows extreme bearish sentiment readings, a contrarian indicator. Growth stocks (especially consumer discretionary and technology) outperformed value (especially energy related stocks, the big winner so far in 2022). It was one of the few good weeks we have had so far in 2022.

As a reminder, in 2007, July hit a new high only to be a precursor of negative things to come (especially in housing). This was the last time we were staring down a possible recession. Many of the negative indicators we explain below were just starting in July 2007. See chart below.

This past week several of the MarketGauge indicators gave early signs of risk on. Mish also caught a few positive trades that her subscribers were able to profit from.

WARNING: Earnings Misses

The recent risk on trend stopped in its tracks on Friday as earnings misses disrupted the recent positive bias. Snap(NYSE:SNAP) reported a huge miss in earnings, and investors dumped the stock on Friday (down 39%), and along with it went other social media giants like Meta (NASDAQ:META) (-7.6%) and Google (NASDAQ:GOOGL) (-5.8%). This sector is plagued by the fact that advertisers are retreating from ad spending on these social media channels.

Additionally, communication stocks were hit hard as Verizon (NYSE:VZ) (-6.7%) reported a big miss in earnings due to a significant reduction of free cash flow resulting from late paying customers and subscribers leaving for a cheaper alternative.

For the first quarter of 2022, 77% of corporations beat their earnings expectations. In anticipation that this trend would not continue, the market sold off.

For this recent quarter, it is expected that approximately 66% of corporations will beat their earnings expectations and grow earnings by an average of 4%. As we mentioned in last week’s Market Outlook, with the US dollar appreciation over the past year (approximately 20%), we believe that this will be a major headwind for the earnings of multinational companies. We’ve now seen this with JPMorgan (NYSE:JPM) and Verizon. We do not believe earnings will grow 4% nor that 66% of companies will beat estimates. This may be the next shoe to drop in the market’s decline.

WARNING: Slowdown in the Economy

We are starting to see the signs many expected from inflation and a slowdown in the economy. We are confident you will remember the many times we have shared with you that the stock market is a forward-looking indicator. We have witnessed a very difficult and downward trending market thus far in 2022. The market has been forecasting that higher prices would lead to aggressive Fed action and an eventual slowdown in corporate earnings. Many stocks, especially technology stocks, are down as much as 50% on the expectation that growth will be slowed or even stopped. Last week we reported on JP Morgan and Morgan Stanley (NYSE:MS). This week it is SNAP, META, and even the consumer staple Verizon. We are confident that there will be more.

WARNING: Stagflation

Last week’s column included a chart showing a steep decline in commodity prices since their highs earlier in the year. We suggested that if some of these, like Copper, Lumber, Oil/Gasoline, and agricultural prices could stay down, we may see a faster recovery.

So far, so good. However, as we know from past challenging inflationary cycles (1970s), these cycles can last much longer than investors may expect. It would not surprise us to see a reacceleration of higher prices later this year as more global supply chain problems could arise.

Here are a few recent replays of Mish on national TV discussing the prospect of ongoing STAGFLATION, which will continue to affect Americans. The truest definition of stagflation is when prices rise while growth is subdued. In this environment, we expect the markets move sideways. The best antidote is to develop a “traders” mentality. We can help you do this.

WARNING: Recession on the horizon?

We have said this before: IT DOESN’T MATTER. Whether or not we are in a recession will not change the difficulties of higher prices and economic headwinds we are currently experiencing. However, we are probably in a recession. We’ll learn more next week when the second quarter GDP is announced. This week the Atlanta Fed, (a very reliable source) reported their belief that second quarter will come in at a contracted -1.6% GDP. Add this to the first quarter, 2022 also at -1.6% GDP, and that would pass the formal definition of two consecutive quarters of negative GDP. That may hit the markets hard as many have been arguing we will not see a recession, even though we are probably already in one based on this formal definition.

WARNING: Increased Volatility (and Risk)

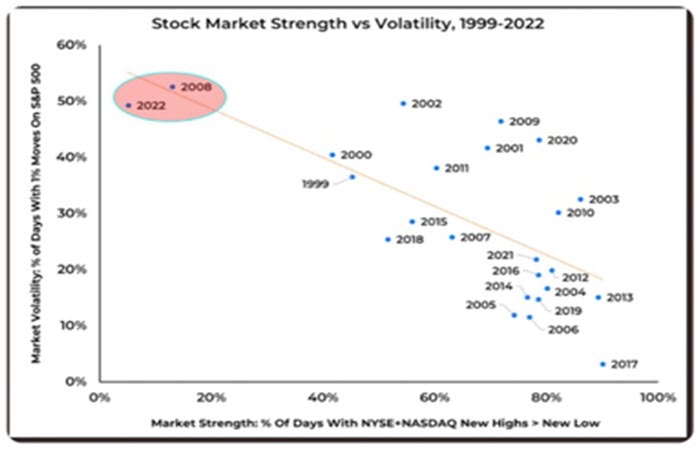

Volatility is a measurement of RISK and variability of prices. Option prices are determined by price and volatility (or risk). We have witnessed a large number of very volatile days with swings of over 1% in the market daily. We have also seen a great number of days that start off negative and turn positive and vice versa. This year resembles 2008 closely, and that indicates to us that wild swings and enhanced volatility will continue. It also implies that we are going to see additional steep sell-offs as earnings are reported, or economic surprises continue. See chart below:

WARNING: Fed Action Approaching

Have we seen the bottom? Given some of the negative indicators mentioned above not likely. With the upcoming Federal Reserve meeting this week, where it is widely expected that the Fed will raise at least 75 basis points, investors will continue to experience a non-accommodative Fed with rising rates and higher borrowing costs. By intention, this should continue to slow down an already slowing economy.

However, on a positive note, the current rally in interest rate instruments looks like a head and shoulder bottom formation. If this pattern breaks out to the upside, it could add some fuel to the short-term upside and even mean that the Fed might be backing off of its aggressive tightening.

WARNING: August in Midterm Election Years

We are entering one of the worst months to invest in the stock market. While August typically is “slow on Wall Street,” given summer vacations and less volume, midterm years have an even more pronounced malaise as investors are not willing to take a stand as to what economic policies could be altered by upcoming elections. This year is no exception. So, we remind you to be cautious this August as the historical track record is not favorable. See chart below:

WARNING: We are in a Bear Market

Bull and bear markets can and usually do last much longer than investors expect. Perhaps we were all spoiled in February-March 2020 when we had a torrid sell-off (due to Covid lockdown) only to see the markets recover in a very short time period. It was the shortest bear market we have ever witnessed.

On a short-term basis bear market rallies tend to be quick and vicious. Short-term Sentiment and Market Internal indicators are bouncing from oversold levels and could give more fuel to the current rally. Our various trading models are giving mixed signals; hence our risk management process is critical to minimizing drawdowns, and using a blend of them is critical to successful trading and investment.

This time will be different. Remember, the biggest investment banking firms are still predicting another 10% or more in downward pressure in the markets. This is not conjecture, but likely due to complicated models they have built factoring in all the above inputs, inflation, earnings, interest rates, economic models, and investor sentiment. Market valuations are all over the place, but some of the most accurate historical gurus have the market going much lower.

Part of their analysis also rests with money flows which remain negative and longer-term market trendlines. The S&P 500 finally cleared the 50-day moving average (DMA) this past week for the first time since April. However, please note that both the 50 DMA (blue line) and the 200 DMA (red line), are negatively sloped, indicating that these longer-term trendlines are still trending down. This is a negative for the markets intermediate and longer term, for now. See chart below: