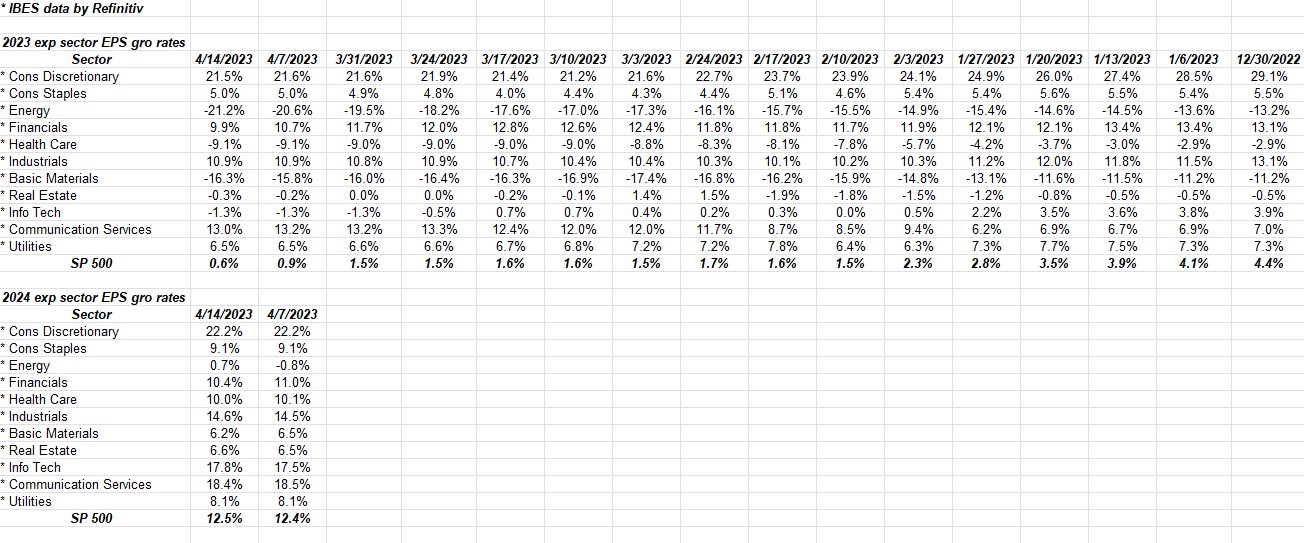

The S&P 500 is up +8.27% YTD (per the Morningstar data), while expected S&P 500 earnings (EPS) growth in 2023 is just +0.6%.

However, as readers can see from the above spreadsheet, the 2024 expected SP 500 sector growth rates are expecting healthier EPS growth than the last few years.

Readers have to remember, while 2024 seems a long way away and much can happen over the next 8.5 months, the fact is the SP 500 is a “discounting” mechanism, so the fact is the SP 500 will begin to incorporate the prospect for higher SP 500 earnings in the year ahead.

That being said, there is a reason this data is updated weekly. Much can change, and quickly too as was learned in 2008.

30 SP 500 companies reported last week, and per the Refinitiv data, 62 are expected to report this coming week, so by next Friday morning, April 21, ’23, about 20% of the SP 500 will have reported Q1 ’23 financial results, and you have to think that a lot of attention will be paid to Charles Schwab (NYSE:SCHW), US Bancorp (NYSE:USB), Truist Financial (NYSE:TFC), FifthThird Bank (FITB)and Regions Bank (RF) this week.

These banks / financials are the 2nd tier of the financial sector (2nd tier meaning market cap and earnings weights within the SP 500 and not the quality of the institution) with Schwab and Truist the two that garnered the most attention after the collapse of Silicon Valley Bank.

PE expansion vs Contraction:

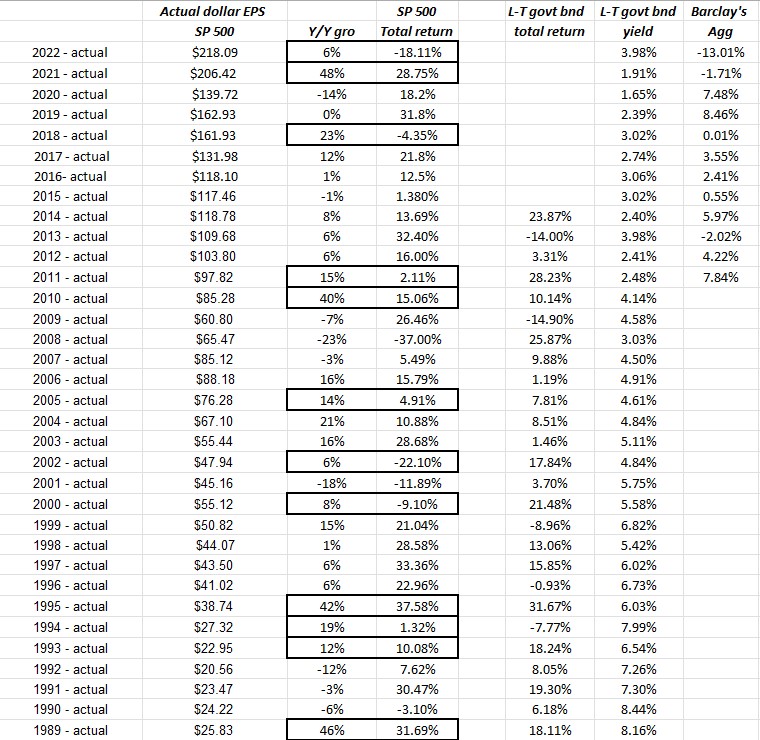

(Click on the above spreadsheet to expand the table for reading.)

The above spreadsheet was started years ago to show how the returns on the SP 500 annually, correlate with the actual SP 500 earnings growth rate for a given calendar year. (The spreadsheet goes deeper into the 1980’s but it couldn’t all be fit to make it legible.)

The dark, bordered boxes are years where the SP 500 demonstrated PE contraction or SP 500 annual earnings growth (3rd column) was greater than SP 500’s annual return (4th column). (Have to apologize right off the bat, 2004 was also a year of PE contraction, even though it’s not highlighted.)

Here’s the point: of the last 34 through 2022, i.e. years where the two data points were compared, i.e. SP 500 annual EPS growth, versus SP 500 annual return, 14 years saw “PE contraction” which means annual SP 500 earnings growth was greater than the return on the SP 500 for that particular year.

What really fascinated me – looking at the table – was that the best years in terms of SP 500 returns – 1991, 1996, 2003, 2013 – were all years where the SP 500 annual earnings growth was either negative (go figure) or mid-single-digits. Only 2003’s 28% return on the SP 500 saw a double-digit SP 500 earnings growth year at 16%.

Another interesting point is that some of the best SP 500 market rallies with the best annual returns tend to occur when overall SP 500 earnings growth is barely positive. Look at the period from 1995 to 1999. This probably speaks to the market-cap issue and the influence of the top-tier of the SP 500 by market cap weight, which was then followed by 2000 to 2006 (6 years inclusive) where 4 of the years saw PE contraction.

Bottom-line: looking at the top of the table, the last 2 years saw PE contraction for the SP 500 and 3 of the last 5 years have seen PE contraction, the obvious Covid influence, from 2020 through 2022. The point of today’s post is not to say we (investors) are due for a year of “PE expansion” but the pattern makes sense and the opening line of this week’s blog shows the potential start of a decent year.

Also, this history kind of smacks up against the financial media rhetoric where bearish investors or traders refer to “poor SP 500 earnings growth” to continually make a bear case. (And the opposite is true as well, “strong earnings growth” leading to bullish prognostications.)

(Finally, this blog started assembling this data years ago when Refinitiv was still Thomson Reuters (NYSE:TRI) and I believe it was Michael Thompson who was at Thomson who (or his team) supplied me with some of the SP 500’s 1980’s EPS data. Michael was a frequent CNBC guest in the late 1990’s and early 2000’s before moving on to other opportunities. Any errors involving the SP 500 EPS data going back to the 1980’s are this blog’s. Today, as is disclosed every week, all SP 500 earnings data is sourced from IBES data by Refinitiv, which is the successor to Thomson Reuters and Thomson Financial.)

Summary/conclusion

The regional banks and smaller financials will likely get all the attention this week, but don’t ignore what is happening in other sectors. What’s interesting to me is that the financial sector – which doesn’t yet include the JP Morgan (JP Morgan), Citigroup (NYSE:C), and PNC Financial (NYSE:PNC) earnings and revenue date from last Friday morning because Refinitiv cuts off the weekly data as of Thursday night, is expecting 10% EPS growth in 2023 and in 2024. The expected financial sector EPS has come down a little since early March ’23 or around the time Silicon Valley Bank collapsed, but not as much as you’d expect given the headlines.

Undoubtedly the Fed’s discount window is helping assuage any anxiety over unrealized Treasury losses in the bank portfolios.

The SP 500 is up 8% YTD, while the Russell 2000 (IWM) and the SP Midcap (MDY) have increased 1.61% and 2.9% respectively. The driving influence in terms of YTD returns continues to be the “mega-cap growth” factor with the MGK ETF up 18.9% YTD.

Tesla (NASDAQ:TSLA) reports this week – Wednesday night after the bell – and is still ranked 8th in the SP 500 as of this weekend in terms of market-cap weight. Netflix (NASDAQ:NFLX) reports this week as well, so I’m treating both these companies as an early look at higher PE growth stocks that have fallen out of favor.

Take all of this with a substantial skepticism and a healthy grain of salt. Past performance is no guarantee of future results. This information is provided to anyone that wishes to read the blog, and it may or may not be updated, and if updated, may not be updated in a timely fashion. Capital markets can change quickly, both positively and negatively.

Thanks for reading.