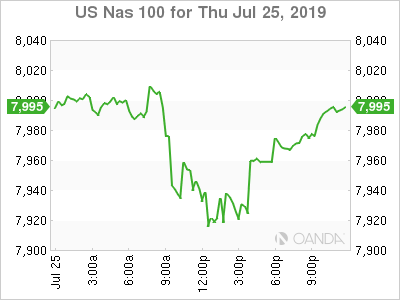

Asian equities are likely to see some pressure in early trade as U.S. markets fell from record highs as a batch of earnings signaled downbeat outlooks and a botched ECB policy message. The ECB decided to show patience in delivering rate cuts and much needed stimulus to the eurozone economy. Markets are getting nervous that Fed could disappoint next week. The data remains strong for the U.S. and it seems every recent print is suggesting the trade war is not making a huge impact on the economy.

After hours saw a couple of giant tech reports that should provide a mixed picture for the tech sector. Google's parent, Alphabet (NASDAQ:GOOGL) delivered a strong sales and profit beat while Amazon (NASDAQ:AMZN) posted mixed earnings and soft third quarter guidance, that targets operating income of $2.1-3.1 billion, over a $1 billion short of analysts’ consensus.

Amazon investors are likely to raise an eyebrow at the decelerating growth in Amazon Web Services, one of its most profitable divisions. Google had a strong increase from other revenue, a positive sign that cloud, hardware and apps are trending in the right direction. Google’s report was mostly positive as spending remained flat and the company decided not to address any of the regulatory probes.

Intel (NASDAQ:INTC) also confirmed the announcement of the sale of their smartphone modem business and delivered a strong profit and raised their guidance. Coffee giant, Starbucks (NASDAQ:SBUX) saw the best sales growth in three years and a remarkable improvement in Chinese sales.

The after-hours picture was overall pretty positive except for Amazon.

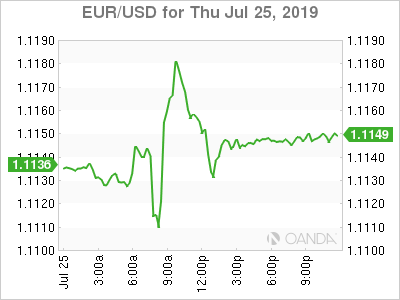

ECB

The ECB’s dovish hold wasn’t as dovish as markets wanted it to be. ECB’s Draghi’s press conference disappointed many and almost seemed to contradict the dovishness of the initial statement. Rate cuts were not on the table for today and the lack of urgency from the ECB is concerning investors that the recessionary risks might come to fruition.

Eskom

The rand was the worst performing currency after the last rating agency to hold South African debt with an investment grade status, warned that increased efforts to rescue South African electricity public utility Eskom is credit negative. Moody’s has warned South Africa in the past that continued support for Eskom will test South Africa’s fiscal deficits and debt levels.The South African currency was due for a pullback and the risks of getting cut to junk status at Moody’s could see continued momentum until we get to the FOMC event at the end of the month.

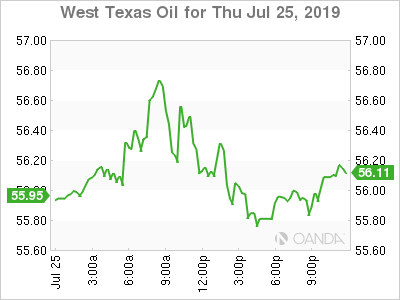

Oil

Crude prices are higher as a tidal wave of stimulus is about to hit the markets. The ECB pretty much queued up a September rate cut, the Fed is ready to go into easing mode and the other major central banks have mostly reiterated dovish pledges. The reason we are not seeing oil significantly higher stems from concerns the ECB might be a little late into using all their toolbox options and that the Fed could disappoint next week. The demand side has been weighing on crude in recent weeks and if we don’t see a bazooka of easing globally, oil prices will easily test last month’s low.

Gold

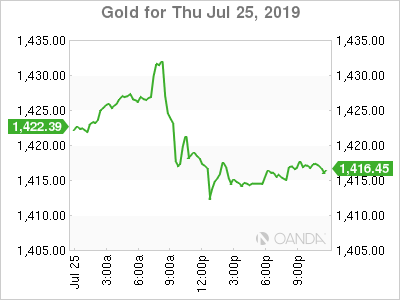

Gold prices continue to react sharply to U.S. economic data. The yellow metal sold off after U.S. factory order data posted the best gain in more than a year and shipments also surprised to the upside. Today’s data suggest the trade war is not hitting the U.S. economy that hard. The labor situation also remains robust after the Labor department showed filing for unemployment benefits dropped to a three-month low.

Gold’s selloff should be short-lived as low inflation will likely keep the Fed committed to a significant easing cycle despite continued labor strength and improved momentum despite the effects of the trade war and overall global weakness.

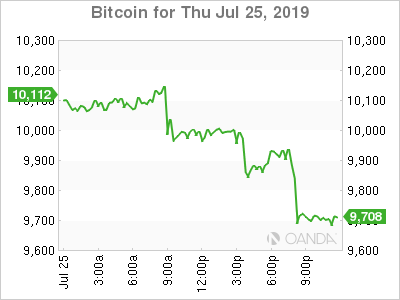

Bitcoin

Bitcoin enthusiasts are also getting some increased demand from developing countries. Research from Digital Assets data showed Bitcoin is gaining traction in developing countries as diversification needs from their local currencies grow. If we do see an emerging-market sovereign debt crisis emerge, we could see crypto currencies see strong demand as investors try to get out of their local assets.Bitcoin interest remains on the uptrend and bullish momentum could return as regulatory concerns ease.