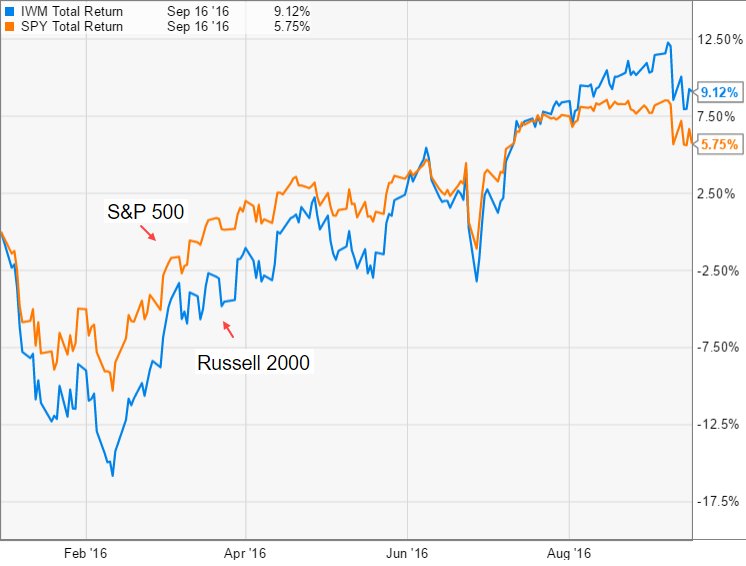

We begin with the United States where consumer inflation surprised to the upside.

1. The chart below shows US core CPI which came in a bit above consensus.

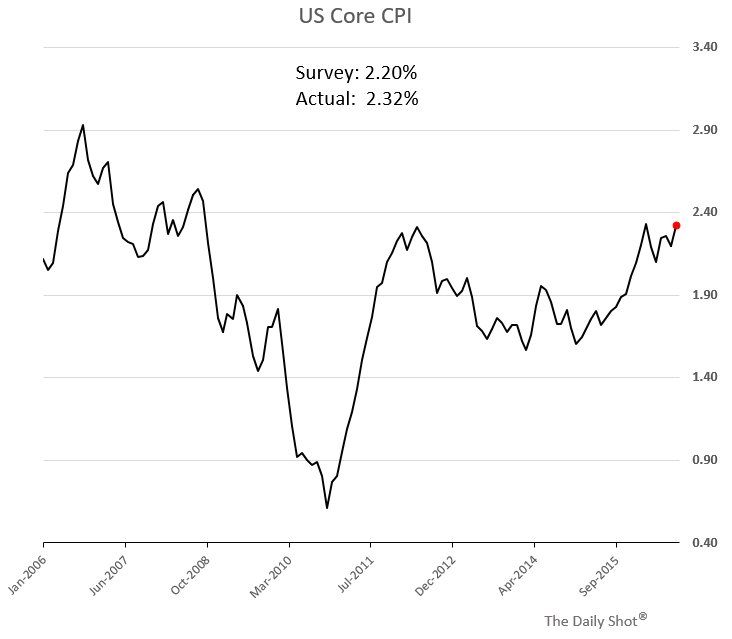

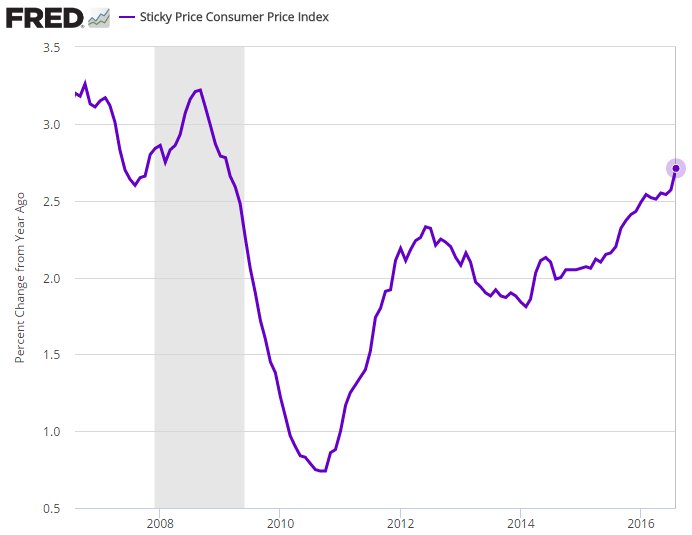

2. Other inflation measures tracked closely by the Fed, the so-called "sticky CPI" and the 16% Trimmed-Mean CPI moved higher as well.

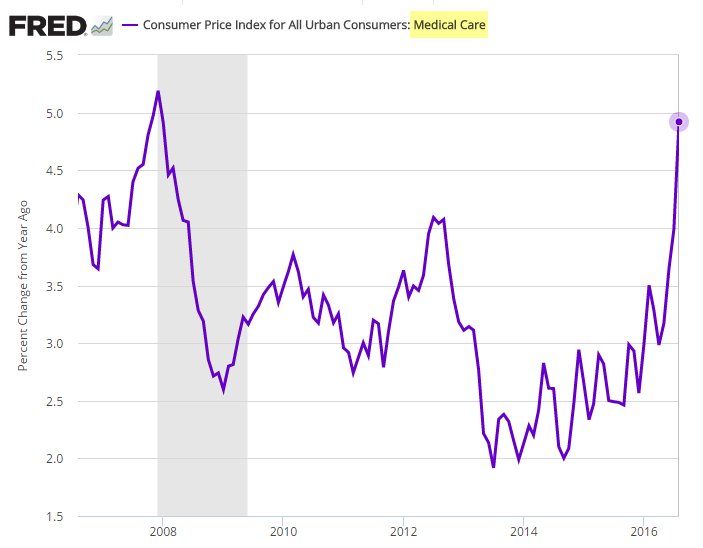

3. While it's easy to get excited about these increases - leading to the conclusion that the Fed must raise rates soon, some caution is required here. The bulk of the increase came from the medical care component of the CPI, and it's not at all clear how rate hikes would "cure" this problem.

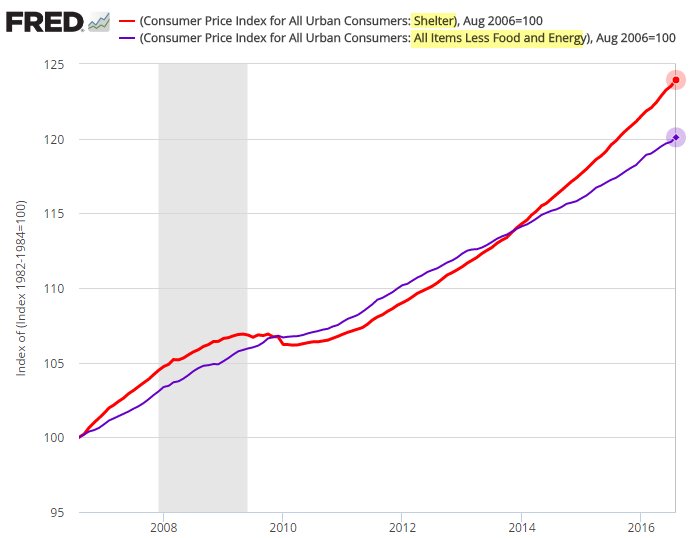

4. The other component of inflation that remains robust is "shelter CPI." The chart below shows how housing costs compare with the overall core CPI over the past ten years. Some suggest that a rate hike is required to cool housing costs. However, most of these increases come from rental expenses, and there is little evidence that higher rates reduce rents. In fact, higher financing costs could exacerbate the shortages of rental housing by lowering new construction activity.

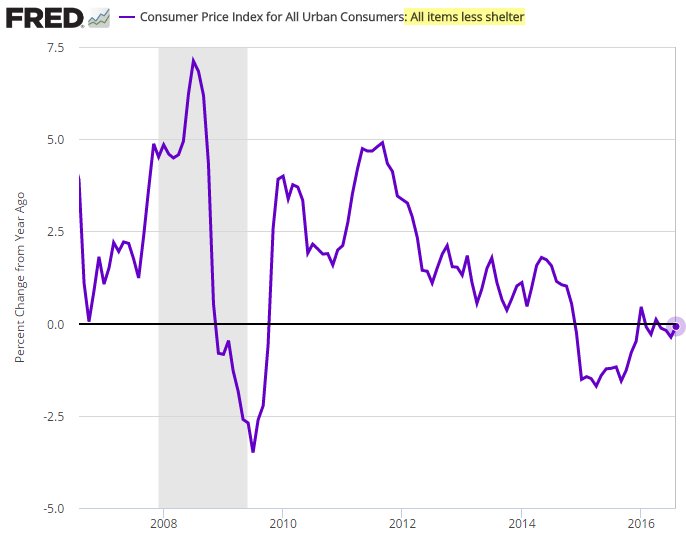

5. The ex-shelter CPI is basically flat (chart below) and without the medical care price jump the US is in deflation.

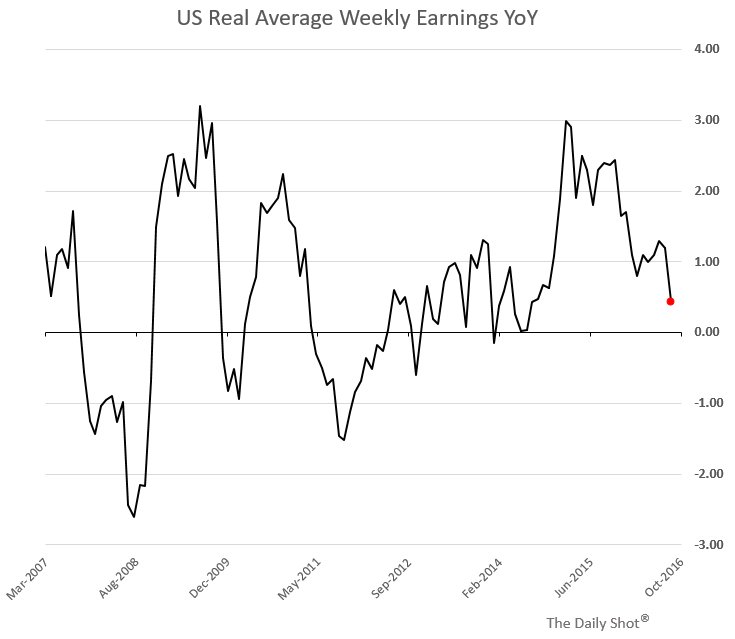

6. Moreover, US real earnings growth is stalling. Once real wage increases move into negative territory, it will be difficult to sustain any inflation.

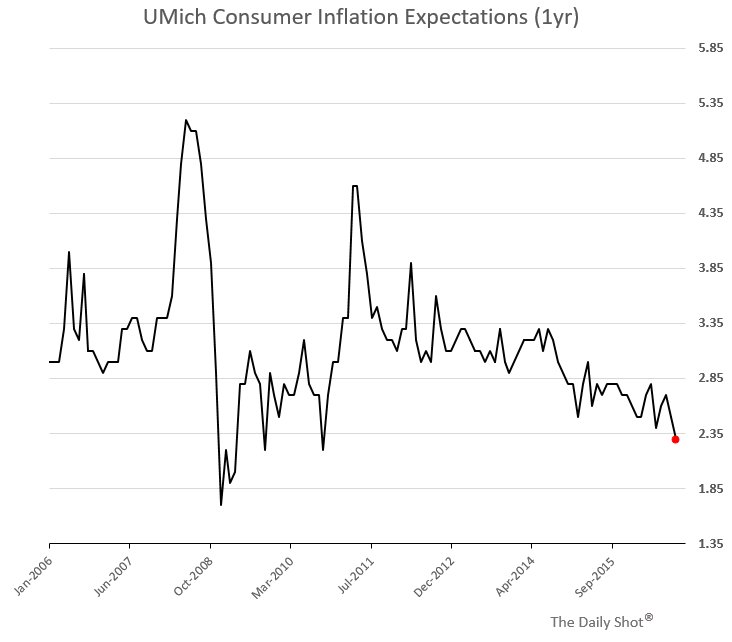

7. Finally, the U. Michigan consumer inflation expectations are at the lowest level since 2010.

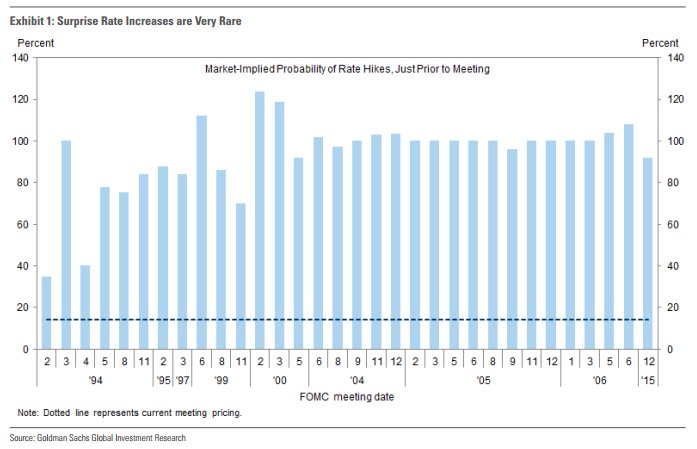

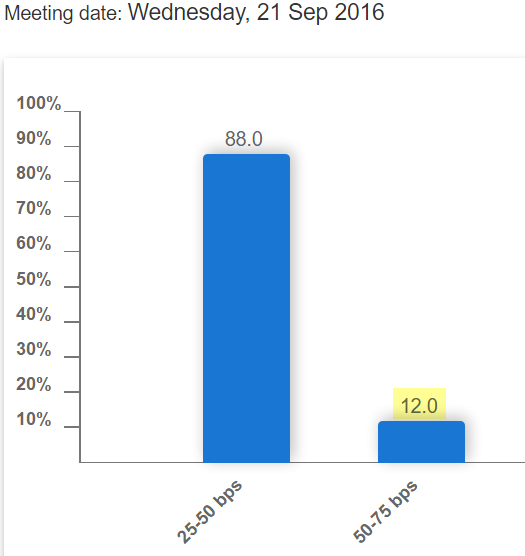

1. In other US economic developments, Goldman points out that "surprise" rate hikes are rare. The chart below shows the futures-implied probability before each rate hike since 1994. Many of the expectations were above 100% because the markets were pricing in some likelihood of a 50bp hike (vs. 25bp). It's difficult to imagine the Fed shocking the market when the implied probability is below 20% (currently, the CME calculation shows it at 12% - second chart below).

2. The US ECRI leading indicator continues to rise and is starting to look a bit suspect. This measure is inconsistent with most other economic signals we've been getting.

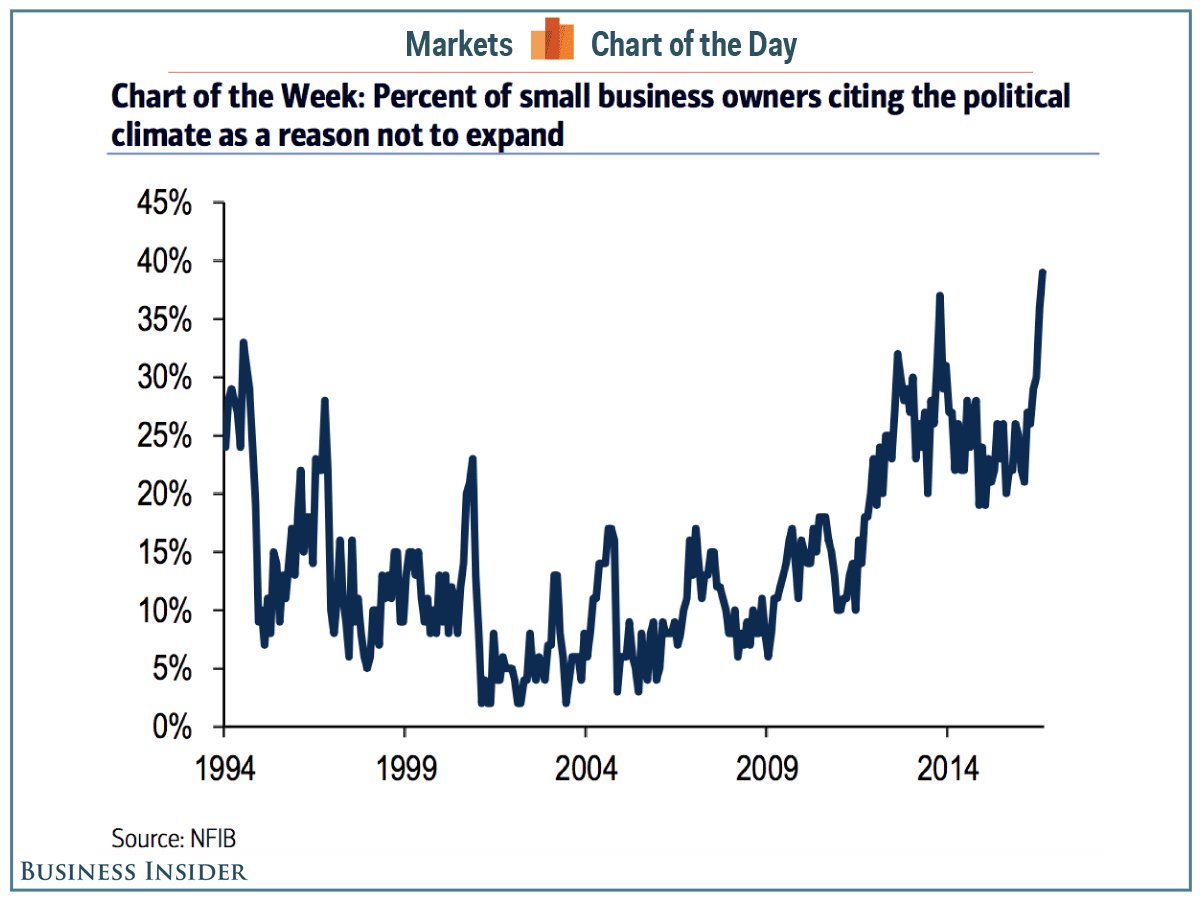

3. Business Insider points out that US small business sentiment is negatively impacted by the current political climate.

4. The US dollar rose sharply on Friday in response to the inflation report. Will the rally continue once analysts scale back their rate hike concerns?

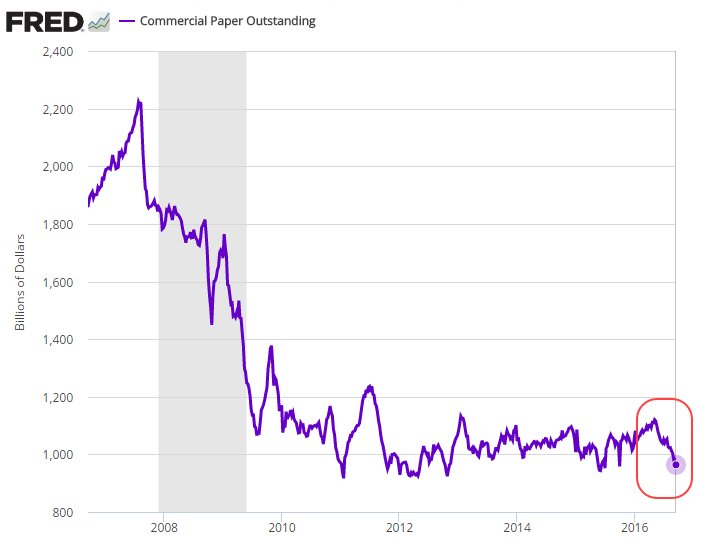

5. The dollar-denominated commercial paper market has been hit by the looming money market regulation.

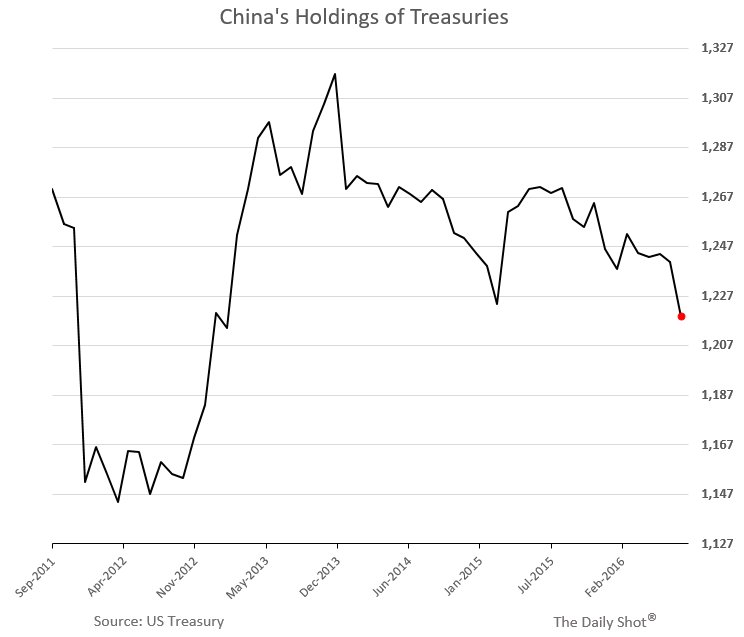

6. China’s holdings of US Treasuries falls to the lowest level since 2013.

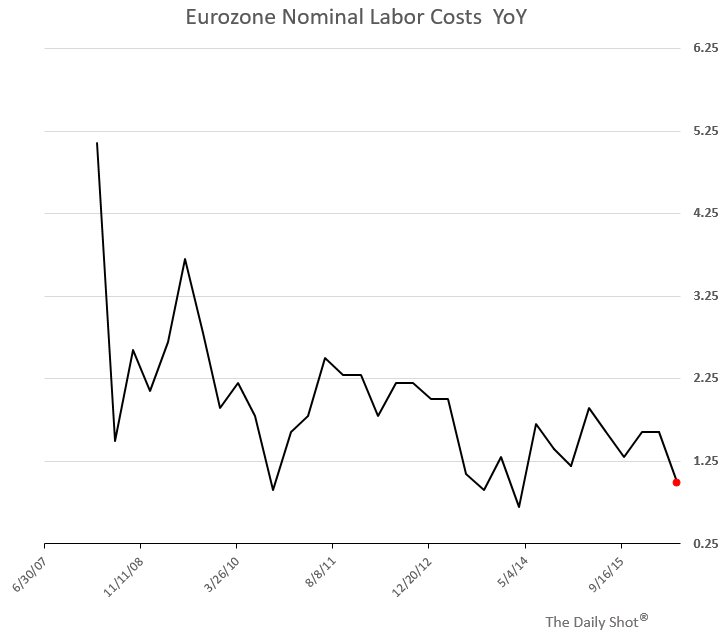

1. Turning to the Eurozone, the bloc's labor markets continue to contribute to disinflationary pressures as labor cost growth slows.

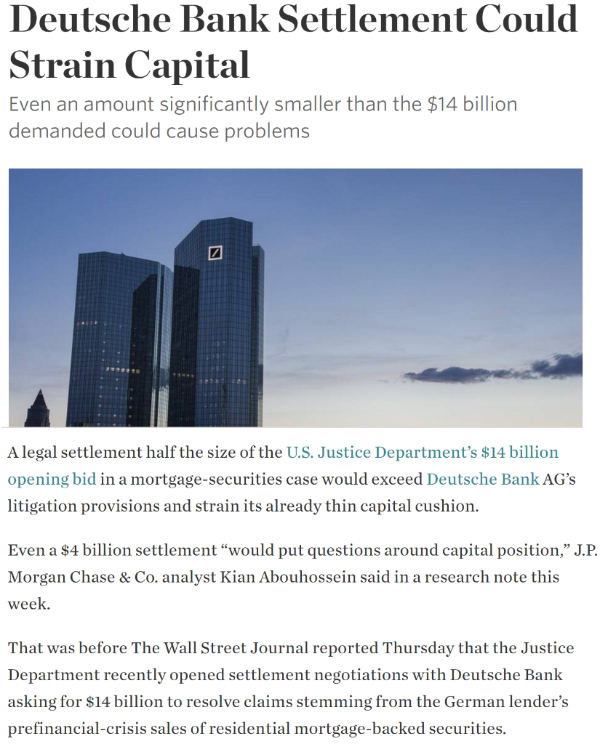

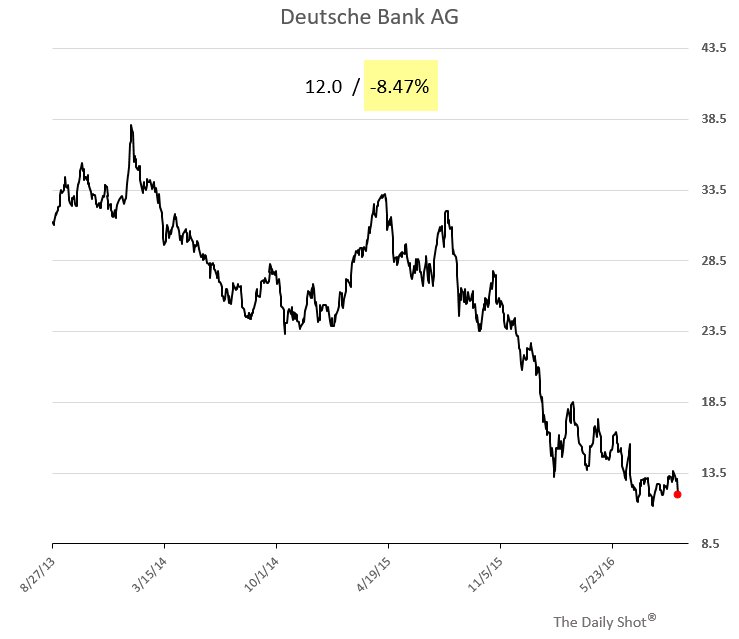

2. Deutsche Bank (NYSE:DB) is in the news again. Rumors persist that Angela Merkel wants the bank to merge or be acquired in order resolve the undercapitalization problem. The latest issue with the US Justice Department penalties is exacerbating the situation.

Deutsche Bank shares gave up 8.5% on Friday.

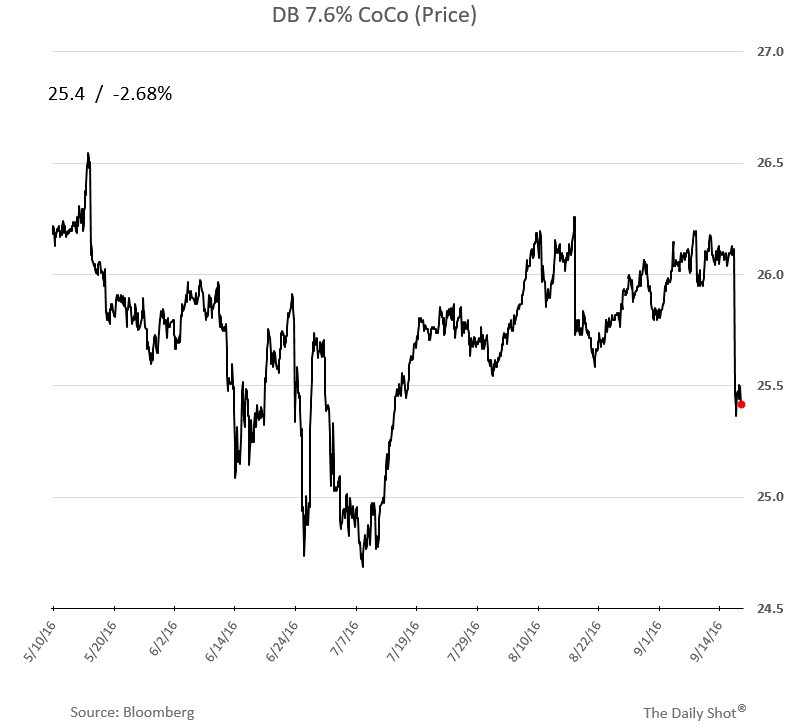

And the bank's CoCos (see definition here) took a hit on the news of the confrontation with the US authorities.

3. Another troubled Eurozone bank, Banca Monte dei Paschi di Siena (OTC:BMDPY), saw its share price give up over 9% on Friday.

Switching to the UK, the British pound sold off sharply. With the persistent currency weakness, UK's inflation expectations are rising (more on this later).

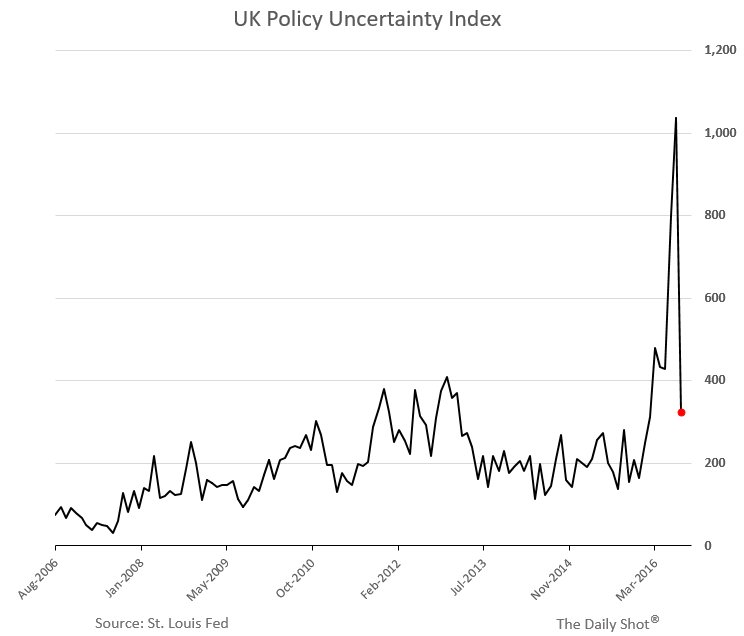

Separately, here is the UK policy uncertainty index.

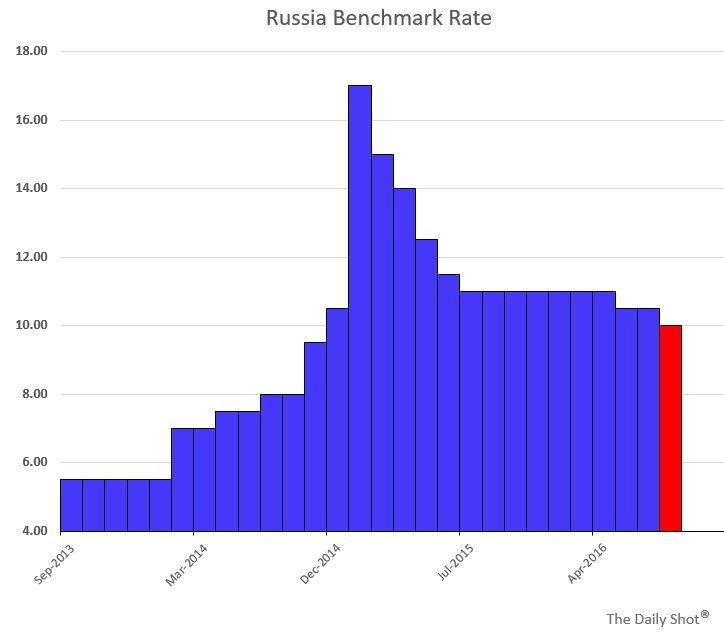

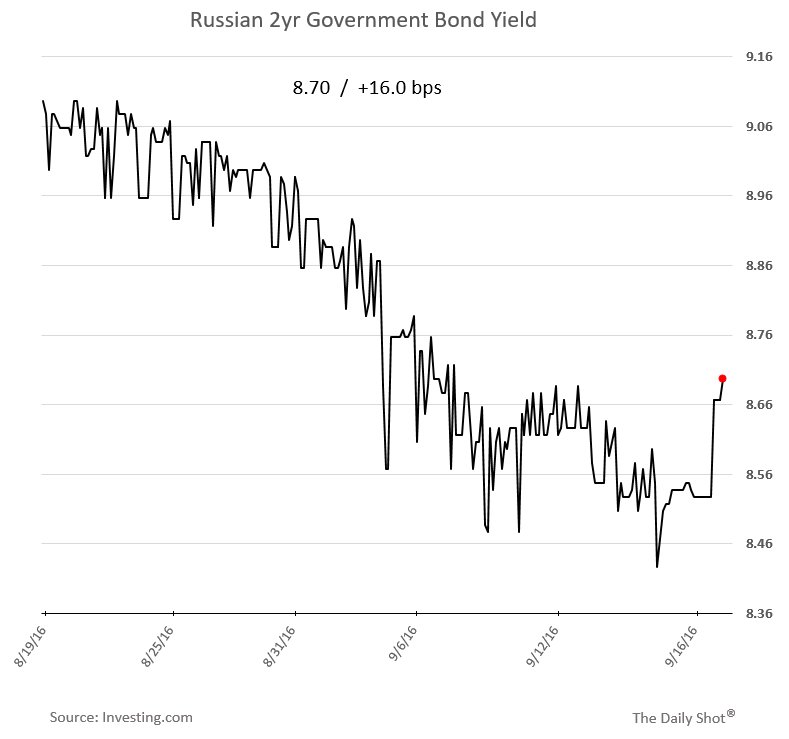

1. Now on to emerging markets where the Russian central bank cut interest rate further.

2. Russian bond yields rose sharply because, according to the central bank, this is the last cut of the year. This announcement surprised the markets.

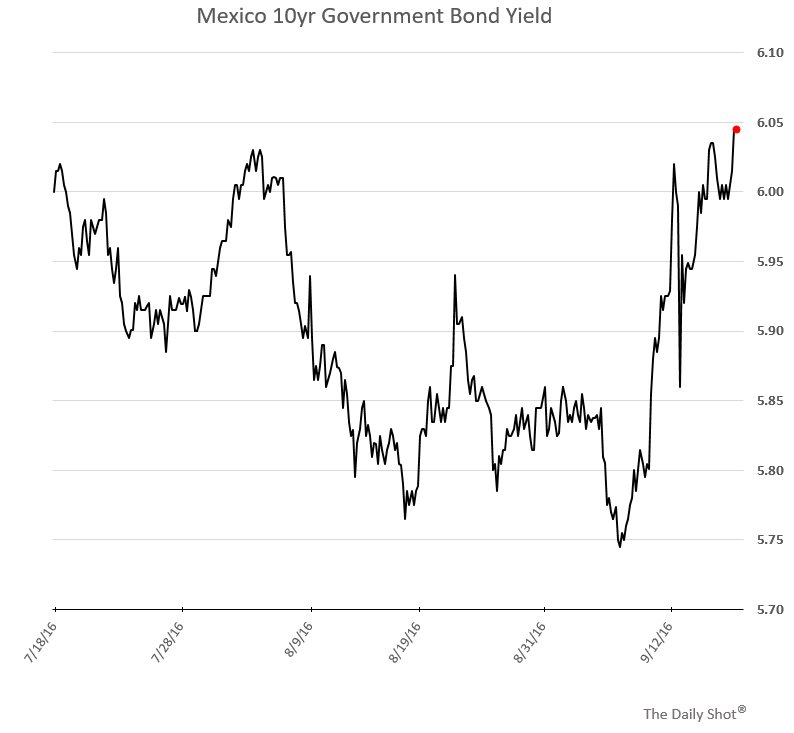

3. Speaking of rising yields, here is the Mexican 10-Year government bond yield.

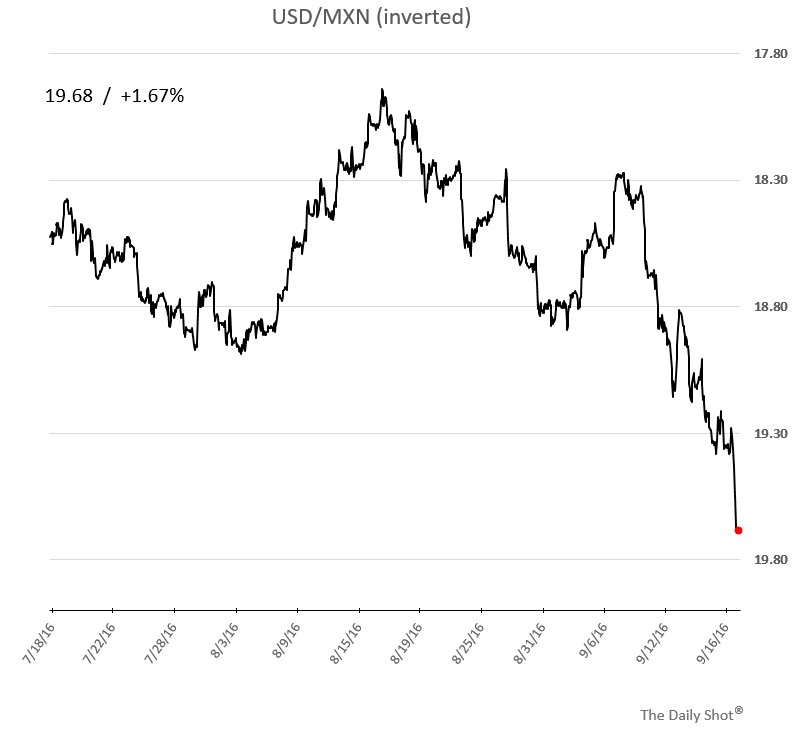

4. The Mexican peso hit record lows - approaching 20 pesos to the dollar. Some have suggested that this sharp decline is in part the result of Donald Trump doing better in the polls. Ironically such low valuations in the peso will incentivise even more US firms to move a larger portion of their operations south of the border.

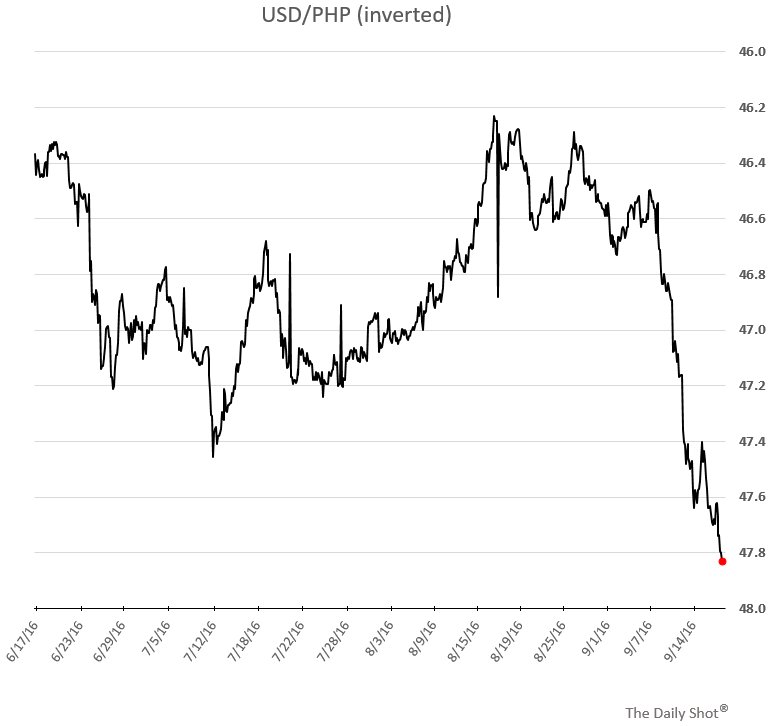

5. The Philippine peso is now down 8 days in a row as the markets remain nervous about Rodrigo Duterte.

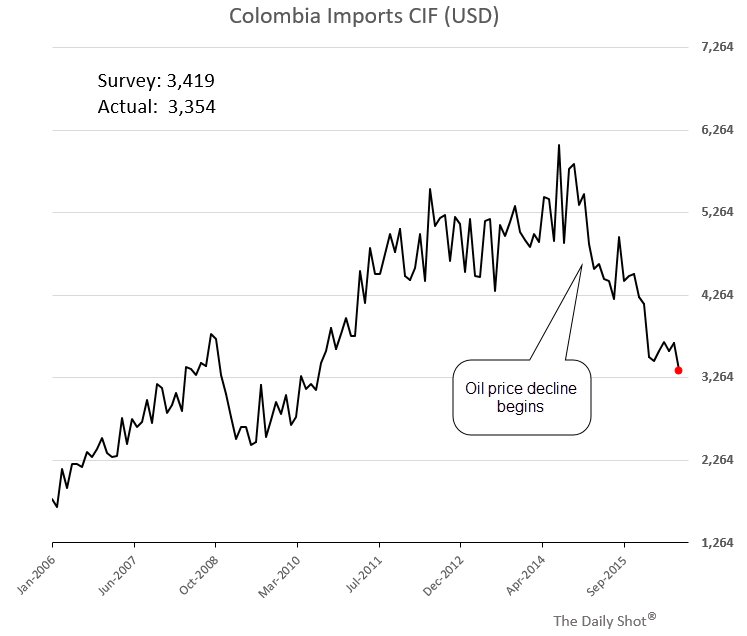

6. Colombia's imports are collapsing.

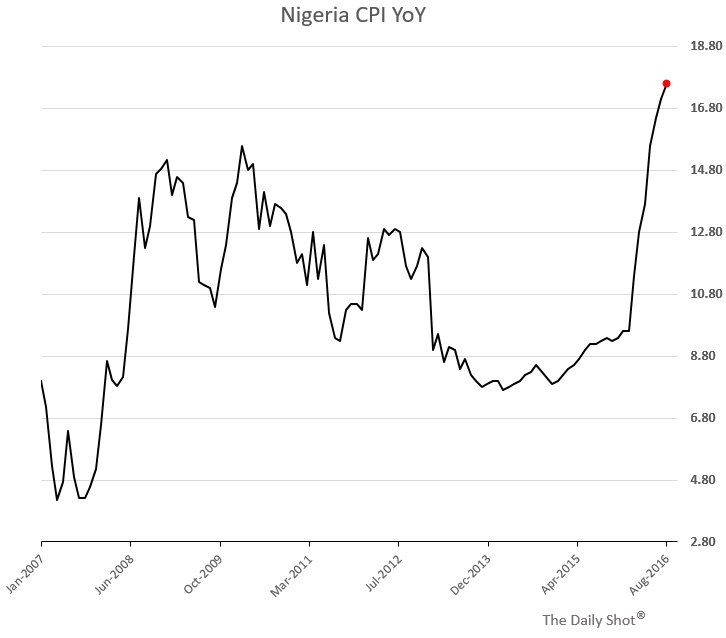

7. Nigeria CPI continues to rise in response to some 40% devaluation of the currency over the past few months. The Central Bank of Nigeria rate hike is coming shortly.

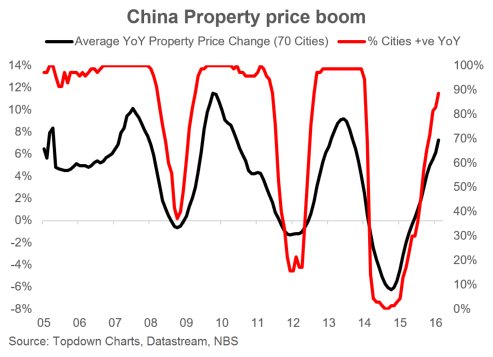

8. China's property prices continue to move higher.

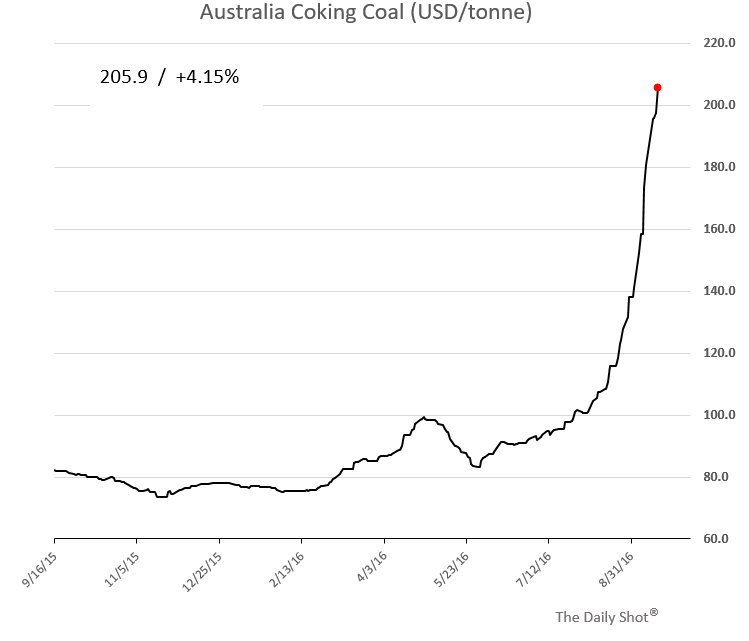

1. We now turn to commodities where metallurgical Coal price blasts past $200/tonne (discussed last week).

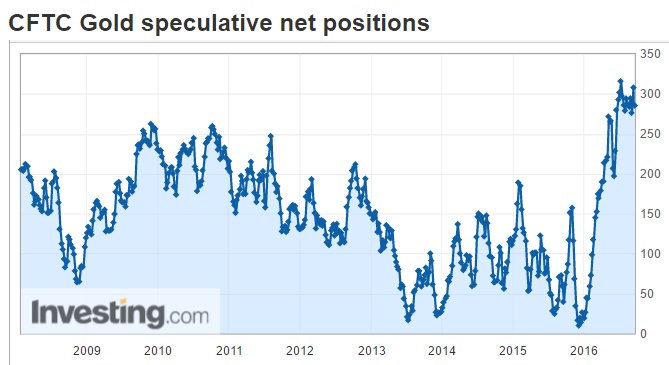

2. Gold and silver speculative positions remain elevated.

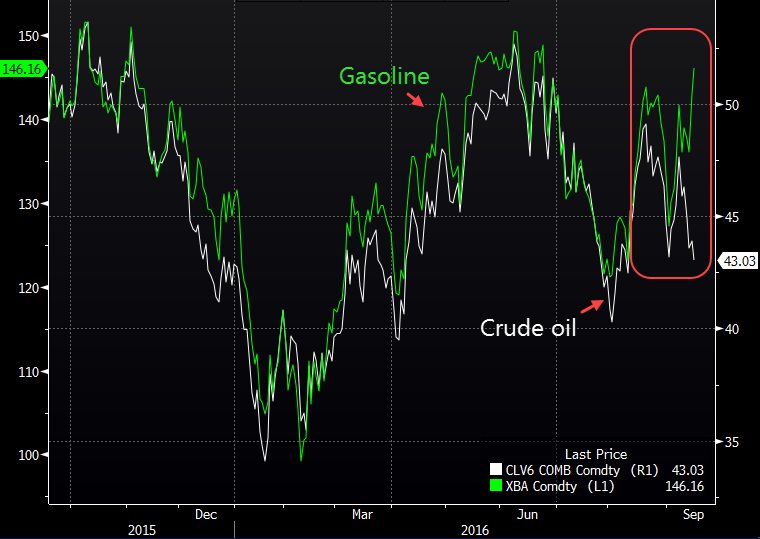

3. A pipeline problem sent US Northeast gasoline prices sharply higher in a stark divergence from crude oil.

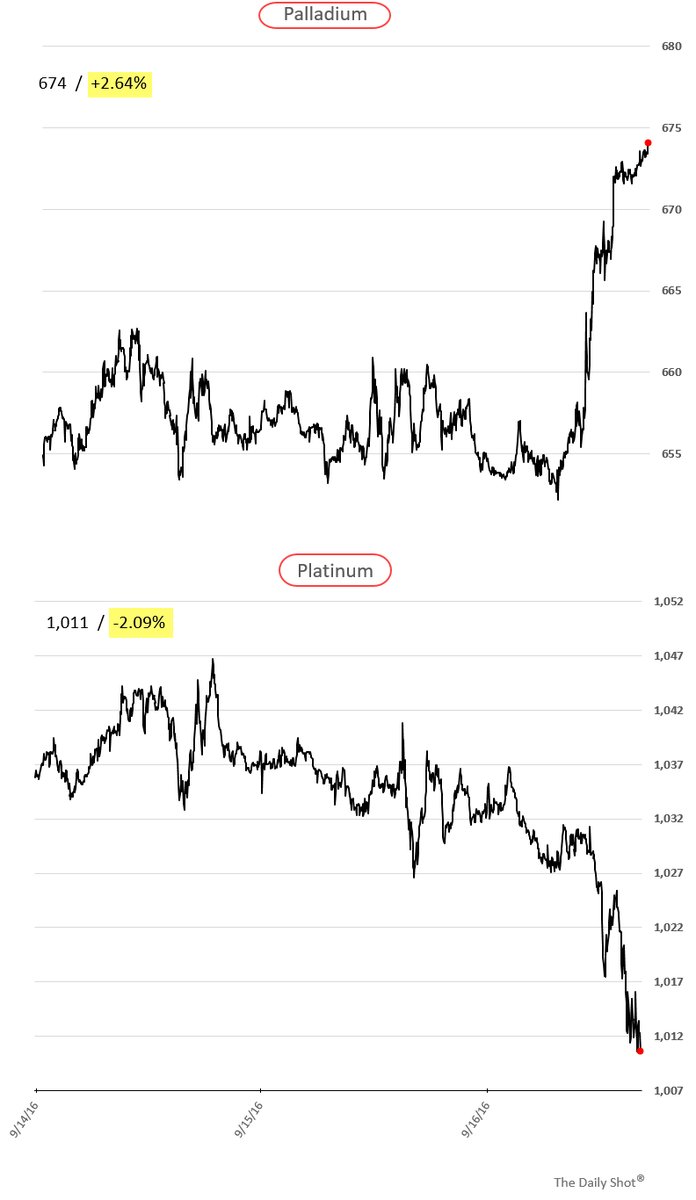

4. Speaking of divergence here is what happened to platinum and palladium on Friday. Is it once again driven by the VW diesel vs. gasoline auto production (catalytic converters)?

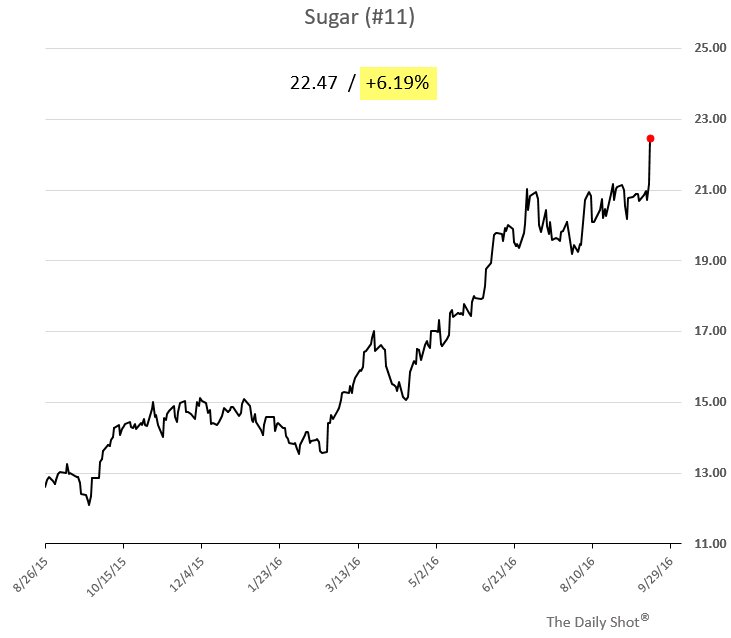

5. Sugar prices jumped 6% on Friday, nearing a 4-year high. The explanation is below.

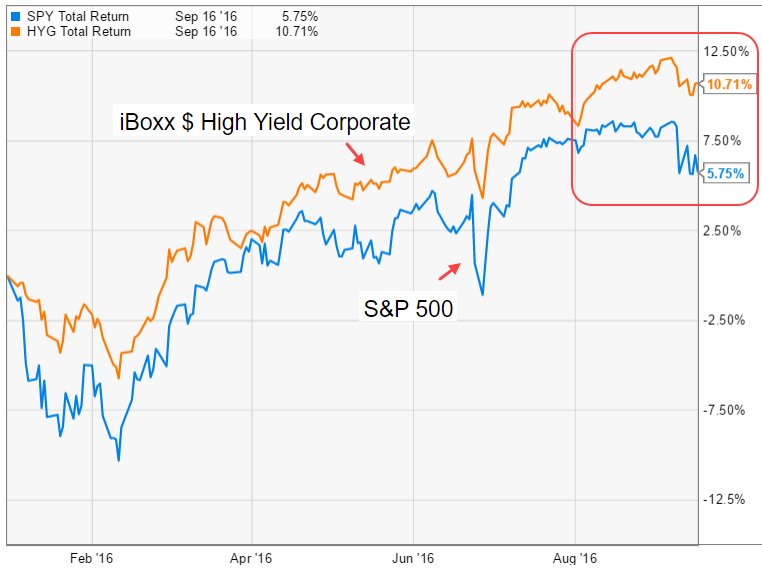

1. In US equity and credit markets, corporate HY bonds continue to outperform stocks (year-to-date).

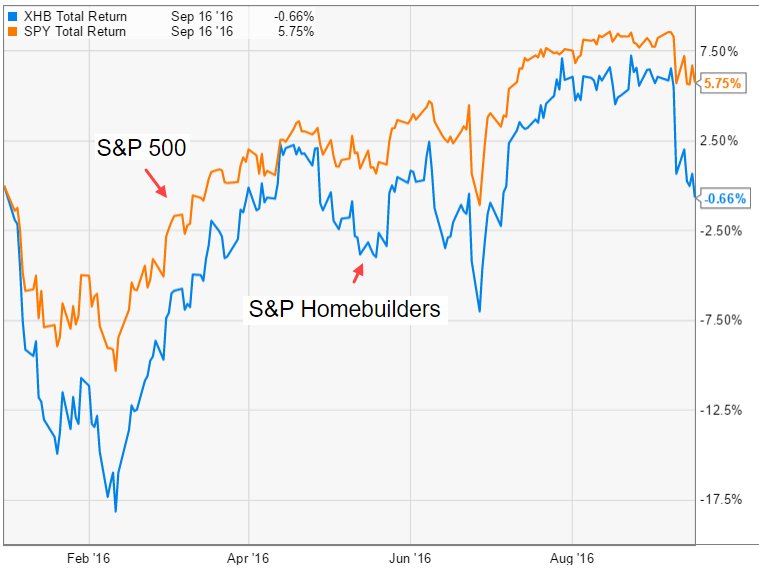

2. US homebuilders have underperformed sharply in the past few days.

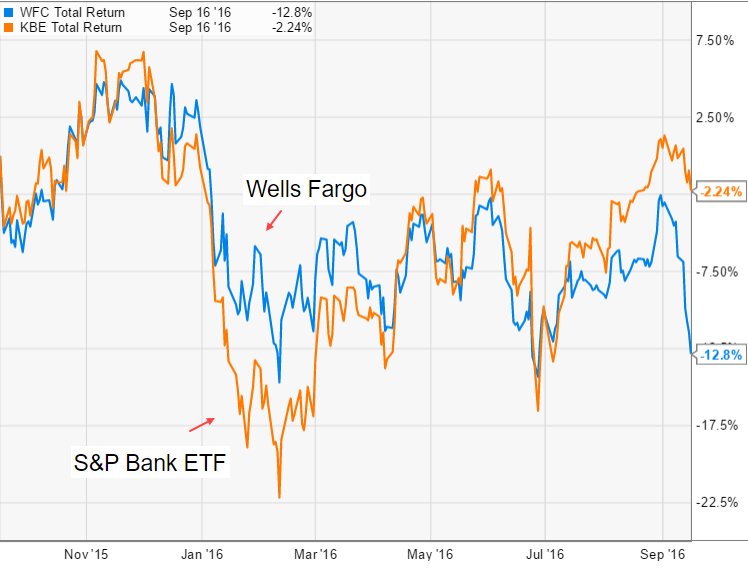

3. Wells Fargo (NYSE:WFC) is under pressure.

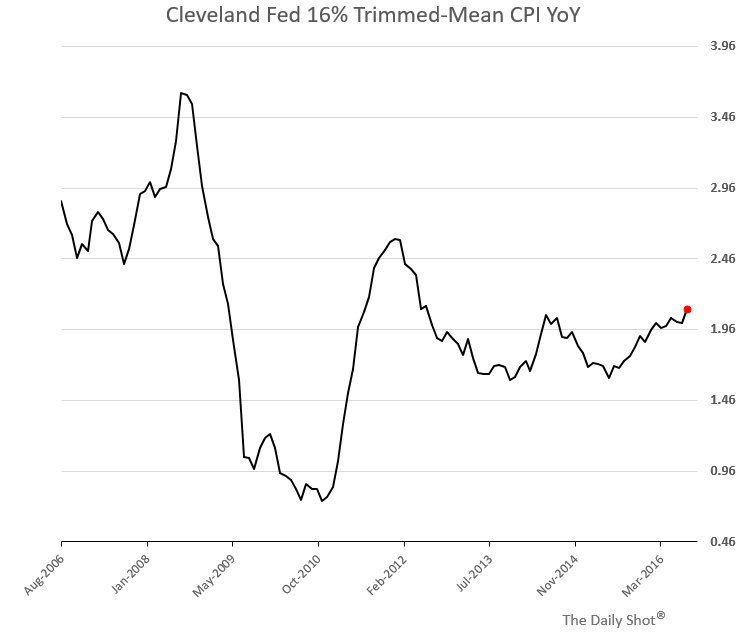

4. Finally, US small caps continue to outperform (year-to-date).