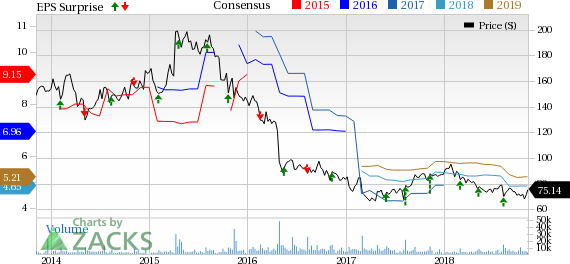

Perrigo Company plc (NYSE:PRGO) reported third-quarter 2018 adjusted earnings of $1.09 per share, which beat the Zacks Consensus Estimate of $1.05. Earnings fell 21.9% year over year.

Net sales in the reported quarter decreased 8% year over year to $1.13 billion, missing the Zacks Consensus Estimate of $1.17 billion. The decline was mainly due to lower sales volume in prescription segment. Sales of $35 million from new products were partially offset by loss of $9 million in sales of discontinued products.

Perrigo’s shares were down 10% in pre-market trading on Thursday possibly due to lowered earnings and revenue guidance for 2018. The company’s shares have declined 13.8% against the industry’s increase of 2.7%.

Segment Discussion

The company reports under three segments: Consumer Health Care Americas (“CHCA”), Consumer Healthcare International (“CHCI”) and Prescription Pharmaceuticals (“RX”).

CHCA: CHCA net sales in the third quarter of 2018 came in at $596 million, down 0.4% year over year. This downside can be attributed to lower net sales in the animal health business and gastrointestinal categories. However, strong performance of smoking cessation, infant nutrition and dermatological categories partially offset the decline in CHCA net sales. While new product sales of $13 million contributed to the top line, the company lost sales of $1 million from discontinued products. Excluding animal health category, sales increased 3% organically.

CHCI:CHCI segment reported net sales of $358 million, down 2.1% from the year-ago period. However, sales increased 0.6% on a constant currency basis. Excluding the exited Russian and unprofitable distribution businesses in 2017 and unfavorable foreign currency movements of $10 million, net revenues increased 1%. The growth was driven by higher sales of anti-parasite and personal care categories, partially offset by lower sales in lifestyle category and non-branded U.K. businesses.

While new product sales of $19 million contributed to the top line, the company lost sales of $5 million from discontinued products.

RX: This segment’s net sales declined 28.5% to $179 million on a reported basis as well as on a constant-currency basis. The decline in sales was due to lower sales volume amid challenges in generics market and customer services. Lost sales due to discontinued products were $4 million.

2018 Earnings Outlook

Perrigo lowered its full-year revenue guidance and now expects it to be approximately $4.72 billion in 2018 compared with the previous expectation of $4.8-$4.9 billion. This includes the impact of reduced RX segment sales outlook and unfavorable foreign currency movement expectation of $65 million

The company also reduced its adjusted earnings guidance to the band of $4.45 to $4.65 per share from the previously announced $4.75 to $4.95 per share due to pricing pressure in Rx segment and reduced margin expectations in the CHCA segment, partially offset by CHCI’s improved expectations.

Our Take

Perrigo’s revenues and margin have been under pressure in 2018 mainly due to the challenges faced by its Rx segment. However, the company will divest this segment to better capitalize on its differentiated generic pharmaceutical products and focus on expanding its leading consumer business

Meanwhile, the company is also focusing on switching of prescription drugs to over-the-counter (“OTC”) brands and expanding store brand solution to drive growth in Consumer Healthcare Americas segment. During the quarter, the company gained FDA approval for a stored brand OTC equivalent of Johnson & Johnson’s (NYSE:JNJ) multi-symptom relief drug, Imodium, and also entered into an agreement with Merck (NYSE:MRK) to gain exclusive rights to the OTC version of the latter’s allergy drug, Nasonex nasal spray.

However, Perrigo is likely to face revenue decline and contraction of margins in 2018. Any improvement in margins are likely to happen after Rx divestment which is likely to happen next year. Also, OTC growth strategy is a complex process and will take time to yield results.

Zacks Rank & Stock to Consider

Perrigo currently carries a Zacks Rank #3 (Hold).

Vertex Pharmaceuticals (NASDAQ:VRTX) is a better-ranked stock in the biotech sector, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Vertex’s earnings per share estimates have moved up from $3.75 to $3.83 for 2018 in the past 30 days. The company delivered a positive surprise in all the trailing four quarters with the average beat being 18.94%. Share price of the company has increased 22.7% in a year’s time.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Merck & Co., Inc. (MRK): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Perrigo Company plc (PRGO): Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX): Free Stock Analysis Report

Original post

Zacks Investment Research