Before I take off for the balance of the day, a few ETF charts and some words on each:

First of all, I’ve been beaten down by commodities (oil, gold), recently, so I’m tending to stay away from the likes of DRIP, ERY and JDST — even mild stuff like GLD. The moment of truth is at hand for commodities (NYSE:DBC), but again, I’ve had enough for now. No thanks.

PowerShares DB Commodity Tracking (NYSE:DBC)

I feel better about being short real estate by way of the iShares US Real Estate (NYSE:IYR) short, which has busted its long-term trendline.

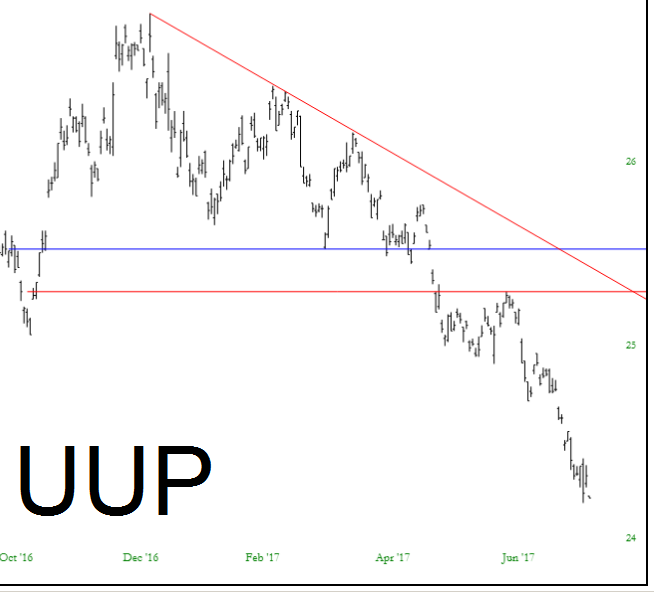

A big reason for gold’s continued strength is that the US dollar keeps plunging. This is very much a “it’s got to go up SOME time” chart, but, here again, forget it. I’m tired of thinking the bottom is in for the dollar. The way Trump/Congress keeps screwing up, I’m not surprised the dollar (and the reputation of our country) is so weak.

PowerShares DB US Dollar Bullish (NYSE:UUP)

I am short financials by way of Financial Select Sector SPDR (NYSE:XLF) (and, incidentally, am long bonds through TLT. The analog seems plain to me:

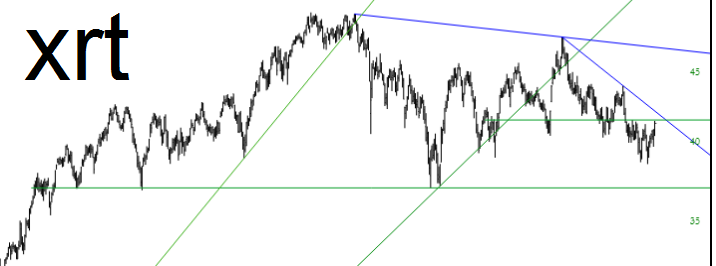

Retail’s strength burned me recently, but I’ve shorted SPDR S&P Retail (NYSE:XRT) and a handful of other stores. I think the likes of Amazon.com (NASDAQ:AMZN) are ultimately going to torch brick ‘n’ mortar.